Spotify: A Compounding Effect

Accelerating user growth despite lower ad spending, on the cusp of a multiyear margin expansion, with 3x the scale and a lower stock price compared to the 2018 direct listing?

From a long-term investor’s perspective, Spotify’s first-quarter report was really strong. I’m not talking about the backward-looking financial metrics—gross margin is still ~25%, operating expenses are still too high, and operating income is still negative. But a snapshot in time is far less important than where the puck is going. And on the margin, it feels like we’re on the cusp of something really great—accelerating user growth, improving gross margins, improving operating expense leverage, and with any luck, a long overdue price increase in major markets that comes with a more favorable revenue split with the labels. With a multiyear perspective in mind, here’s what I found most important.

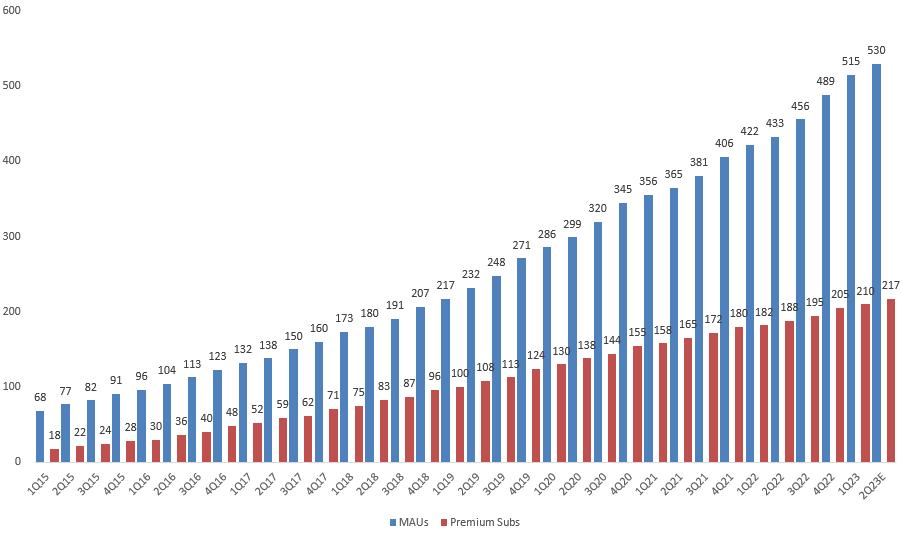

First, the best leading indicator of how big and profitable Spotify can be in the future is user growth. MAUs grew 26 million in the quarter to 515 million, ahead of management’s 500 million guidance. Premium subscribers grew 5 million to 210 million, also ahead of the 207 million guidance. And guidance for the second quarter calls for adding another 15 million and 7 million, respectively, to reach 530 million and 217 million, respectively. This growth is an acceleration from last year’s pace.

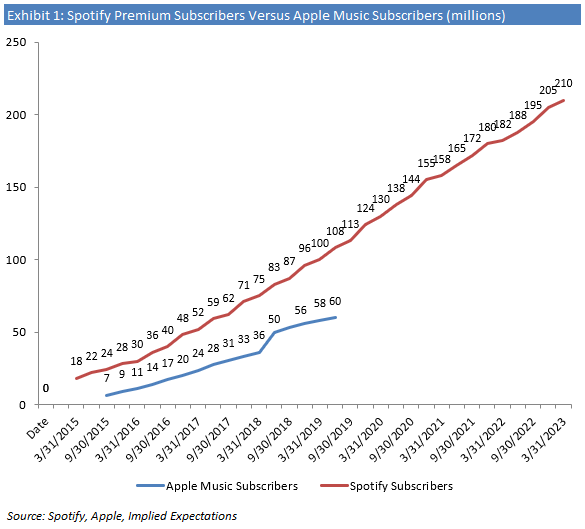

People tend to discount the importance of scale with Spotify because its primary cost—music royalties—is a variable cost. The thinking is that user growth doesn’t create much value because most of the revenue from additional users goes out the door to the rights holders. This is not Netflix with its fixed cost content where the next subscriber comes with no additional content costs. But I still think scale is critical for Spotify in perhaps more nuanced ways. For example, the larger it gets the more it can spend on R&D, which topped €1.4 billion last year and is on pace to grow again this year. R&D is what drives the hundreds, even thousands, of improvements in the product that then contribute to the impressive and even accelerating MAU and Premium sub growth we’ve seen. AI DJ? No one else is innovating like this. Spotify has been able to run circles around the competition for a long time despite using the same raw material—music rights—as its competitors. That’s not intuitive. The difference is Spotify’s continuous investment in product transforms the underlying commodity into a value-added product that consumers undeniably prefer. And that’s only possible with an aggressive R&D budget, which itself is only possible with a meaningful scale advantage.

Exhibit 1 shows Spotify paid subscriber growth versus Apple Music until the latter stopped disclosing it in 2019. The more hopeless it seems for competitors, the less you’d expect them to spend on R&D, the greater Spotify’s product advantage becomes, which drives more consumers to Spotify, which drives lower CAC, which we may be seeing right now. More on that later.

Furthermore, the more scale Spotify achieves the more important it becomes in the music ecosystem and the more leverage it will have as a platform. Subscriptions and streaming is 69% of Universal Music Group’s recorded music revenue. Spotify is the largest contributor to that. Spotify has gone from the startup that had to beg and even give equity to the labels to obtain music licenses to the 515 million MAU behemoth that is now using its scale and technology chops to get discounted royalties and now appears to be negotiating lower royalties in conjunction with a major price increase. None of this would be possible without scale.

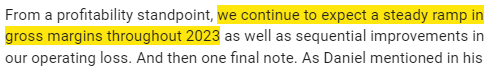

Second, you might have to squint to see it but Spotify’s long stagnant consolidated gross margin finally appears to be heading higher. Gross margin of 25.2% beat guidance by 30 bps and would have been another 10 bps higher without severance charges included in cost of sales. That’s only marginally higher versus a year ago, but second-quarter guidance of 25.5% gross margin would be a 90 bps year-over-year increase and the highest consolidated gross margin since 2021. This is the result of what management has been saying since last year—podcast investment spending driving big underlying losses will go from deeply negative in 2022 to approaching breakeven and eventually turn substantially positive. That’s going to allow more of the higher and improving music gross margins to shine through, resulting in a higher consolidated gross margin. Here’s CFO Paul Vogel on the first-quarter call reiterating what management has been saying for a while:

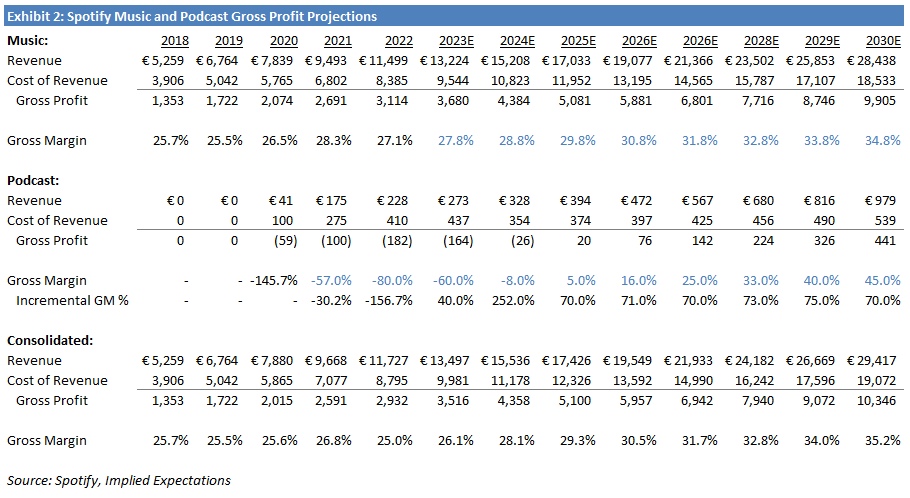

Here’s an exhibit I last posted in Spotify: Wait for It showing my deconsolidation of the company’s gross profits between music and podcast:

The company disclosed that music gross margin was 28.3% in 2021 and also that podcast gross margin was -57% so I think that year is pretty dialed in. And we know 2022 was the peak loss year for podcast and should reach profitability in 1-2 years. I also assume continued upticks in music gross margin due to Marketplace growth, which drives margin expansion. If there are royalty concessions in conjunction with price increases, there would represent upside to these margins.

Investors still seem to have margin fatigue with Spotify. Reported gross margins have been stuck on ~25% for several years. Management’s disclosure at its Investor Day last year that music gross margins have expanded 75 bps annually for the last four years and consolidated gross margins are only stuck on 25% because of podcast investments that will moderate and then turn profitable didn’t seem to sway too many people. Management is guiding to gross margin expansion this year and beyond.

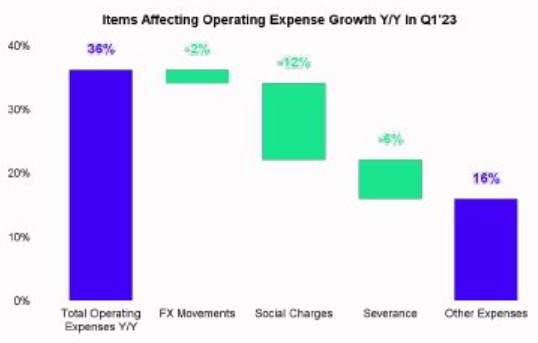

Third, management seems to be getting serious about operating efficiencies. The reported numbers this quarter didn’t show progress year-over-year—opex grew 36% year-over-year (34% in constant currency) and was 30.3% of revenue versus 25.4% a year ago. But this quarter included €41 million of severance charges and €68 million of higher social charges, which are driven by stock price gains. So underlying opex really only increased 16% year-over-year.

And a lot of that was headcount expansion put in motion earlier in 2022. Looking at last year’s opex trend, it looks like the year-over-year improvements in opex will start to shine through in the second quarter. It seems to me we are at the start of a multi-year improvement in profitability that’s been deferred continuously in the name of growth spending. From the shareholder letter:

But two things jump out at me as especially interesting about this. First, there’s actually no indication that Spotify’s profitability inflection will be coming at the expense of growth. More often than not, growing companies that run into a growth wall pare back investment spending, get more efficient, and strong growth rates become a thing of the past. We’ve seen that too many times to count over the last 1-2 years. In contrast, Spotify is seeing really strong, even accelerating user growth in conjunction with improving profitability.

Second, Spotify has 3x the MAUs, 2.8x the Premium subs, and 2.7x the revenue as it had at its direct listing in 2018 and seems likely to go on a multi-year run of improving profitability with that far larger user and revenue base. And yet the stock is still down over five years from the 2018 direct listing. That could be an opportunity.

Falling CAC?

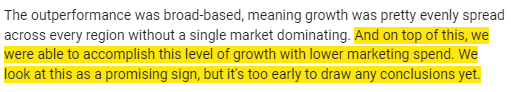

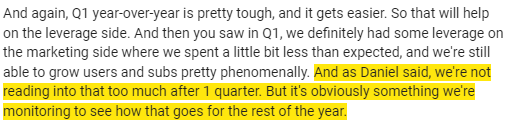

Spotify had accelerating user and sub growth last quarter despite slashing spending on advertising campaigns by €40 million year-over-year. While they did increase spending for advertising of sponsorships and events by €24 million, that is still a €16 million net decrease in ad spending. It seems like management is excited by this but reluctant to express it prematurely. Here’s Daniel:

And here’s CFO Paul Vogel:

Subscription business economics are governed by LTV/CAC, which is the lifetime value of a user or subscriber compared to the cost of acquiring that user or subscriber. To the extent Spotify can acquire users meaningfully more cheaply than it could historically should be very good for long-term business growth and future margin potential.

I think a big part of this is the continuous innovation culture that’s made possible by scale, which drives a better product, which drives faster sign ups and higher retention than peers. It is so easy and almost rational to assume a fairly even playing field in this business that’s largely driven by a ubiquitous commodity among the players yet that is clearly not the case. More investors should ask themselves why.

Scale Advantage with Podcast Content Costs

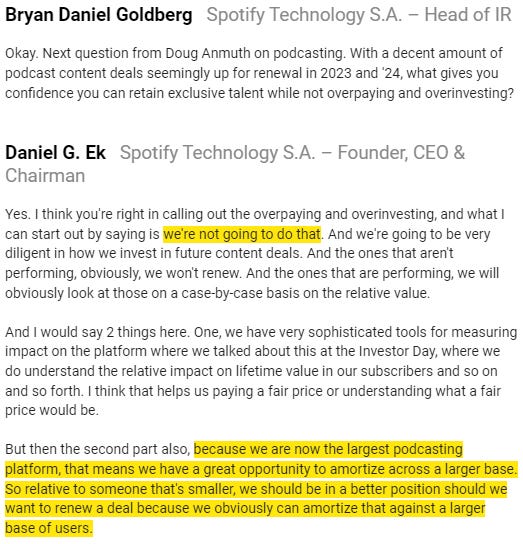

I thought this part of the call was especially interesting.

Given the podcast losses and the drag on gross margin, analysts are right to wonder about the owned and exclusive podcast talent and how those costs may evolve over time. I think it’s easy for many to assume that the cost of this sort of content must rise over time. Look at the value of sports rights, for example. But I don’t think that’s necessarily true here. Like any auction, the amount Spotify will need to pay is going to be a function of the next highest bidder. With sports rights, you have several players who have monetized sports content basically the same way for a long time who can make competitive offers. But with Spotify, the greater their scale advantage over would-be competitive bidders, the lower the next highest bidder’s bid will be. That becomes increasingly true over time to the extent Spotify’s podcast MAU lead grows because it could have a much larger audience and O&E podcast content costs that are essentially governed by the number-two podcast bidder’s audience and ability to monetize.

Just like Paramount+ does not have the revenue scale to invest $100-$200 million in straight-to-streaming movies while Netflix has a history of doing exactly that, Apple or Pandora or Stitcher or Overcast or some other podcast app is just not going to spend the “over $200 million” for Joe Rogan that Spotify did. Apple isn’t even in the ad business yet—for reasons that are inexplicable to me—and seems unlikely to associate its brand with edgy content the way Spotify is comfortable doing—so it can’t monetize O&E podcast talent. As for Pandora and Stitcher, both owned by SiriusXM, Pandora is a small U.S.-only business that continues to lose users and relevancy and the Stitcher acquisition seemed doomed from the start. Other tiny podcast apps can’t consider it. In the unimaginable event that one of these competitors could economically justify outbidding Spotify, popular talent is unlikely to join a smaller platform with a smaller audience. Talent wants to go where the audience is. I’ll leave you with this insightful but perhaps increasingly ironic quote by former SiriusXM CEO Jim Meyer:

One thing I can tell you about content holders, they want to be on big platforms. Or they want a big check to sacrifice being on a big platform.

Disclosure: Long SPOT

Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.