Spotify: Wait for It

Investors have been waiting a long time for margin expansion.

Spotify reported its third quarter last week. Here is the shareholder letter/slide deck.

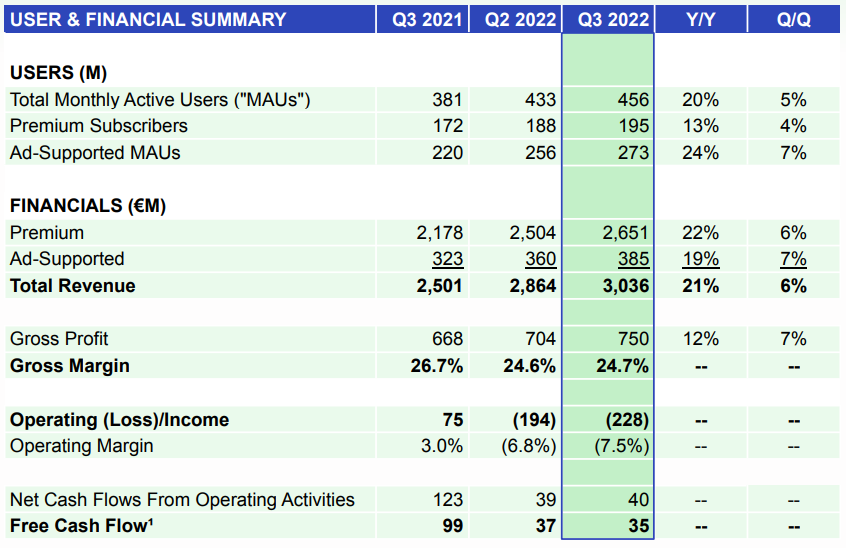

As you can see below, MAU and Premium sub growth continue to hum along. Guidance had been 450 million and 194 million, respectively, so both of those came in ahead. In fact, 26 million MAU net adds was the highest ever for a third quarter. Management now expects year-end MAUs to end the year materially higher than they expected heading into this year.

Revenue was basically in-line with guidance, which had been €3.0 billion, 20% year-over-year growth including a 670 bps benefit from changes in exchange rates, and therefore, ~13% constant currency growth. Revenue came in slightly ahead at €3.036 billion, up 21%, but included a larger ~900 bps tailwind from currency, so constant currency growth was 12%, a slight miss.

Gross margin of 24.7% missed 25.2% guidance. The biggest factor was an accrual to prior period royalties. Essentially, a certain international contract expired about nine quarters ago, Spotify continued to use the content as is standard practice and accrued for expected royalties, and now when the actual contract is expected to be renewed it has to make a one-time adjustment to account for how their prior period estimates had been off. They were off only slightly each quarter, but the cumulative total over nine quarters was a noticeable adjustment. Two other factors were a softening in the ad business, which has higher gross margins, and currency.

Operating income of -€228 million missed the -€218 million guidance. Opex actually came in below management’s expectations but currency was an €85 million headwind, greater than expected. Free cash flow, ex-stock based comp, has been positive for 10 straight quarters.

Big Picture

When I look at Spotify, I see a business that has continued to show really healthy MAU and Premium sub growth over time.

Looking at that exhibit, you would have no idea a global pandemic occurred in the middle of it. Nor would you expect the stock to be down 78% from its high. Why has that happened? It’s a good question. Obviously, interest rates have risen and the environment has changed, especially towards companies that are reinvesting would-be profits today for more profits in the future. Spotify fits that description.

But most companies whose stock prices fell by similar amounts—70%, 80%, 90%—have also run into company-specific issues. Netflix’s growth algo of ~27 million paid net adds annually stopped in its tracks earlier this year. Demand for new Peloton hardware has slowed substantially and prior management had built a cost structure that was unsustainable given the slowdown. Substantial cash burn ensued. Carvana is enduring a recession in the used car business due to this year’s affordability wall and found itself with a cost structure built for far more demand than showed up this year, which has raised serious liquidity concerns. Amazon overbuilt its retail infrastructure and now has negative margins in both its North America and International segments. The list goes on.

What major problem has Spotify encountered? It’s not