Last week, Carvana announced an exchange offer to its existing noteholders. I’ll get to the details in a bit, but probably more interesting was management’s release of preliminary first-quarter results in conjunction with the offer.

Preliminary first-quarter results, specifically regarding SG&A and adjusted EBITDA, meaningfully exceeded expectations. This was roughly consistent with the thesis I outlined in Carvana: Groupthink, although first-quarter adjusted EBITDA will beat my prior estimate as well. Here are the highlights.

On retail units:

It was well-understood that retail units are down a lot due to the affordability environment and management’s aggressive cost cutting efforts—cutting inventory roughly in half, slashing advertising spending, and several other profitability initiatives. There are alternative data sources that were estimating retail units within this range, so this no surprise.

On non-GAAP GPU:

$4,100-$4,400 is a nice bounce back from 4Q’s $2,667, which was depressed primarily due to the inventory write-down and loan sales that were deferred into the first quarter. In Carvana: Groupthink, I had estimated slightly higher first-quarter non-GAAP GPU because I assumed the unusually high amount of loans held for sale would normalize to around $400 million in the first quarter. But as you can see here, they are actually going to end the first quarter with $1.6 billion of loans held for sale, up from $1.3 billion at the end of December.

Essentially, this defers the realization of Other GPU. The large backlog of loans to sell should boost future GPU sooner or later. How quickly this balance returns to more normalized levels remains to be seen. If it’s more quickly, we’ll see a big increase in GPU in a short period of time; if it’s over a longer period of time, we’ll probably see a smaller benefit but perhaps for a longer stretch. In the meantime, Carvana will receive more interest and principal payments on the larger than usual amount of loans held for sale. Management certainly wants to monetize these loans but is willing to wait for more favorable market conditions.

On non-GAAP SG&A:

Non-GAAP SG&A is well ahead of the expectations management set on their fourth-quarter call on February 23. At the time, Ernie said non-GAAP SG&A should decline by $100 million from the fourth quarter to the second quarter. That would be a decline from $523 million to $423 million. As I showed in Carvana: Groupthink, I took that at face value and guessed we’d see $468 million in 1Q and then $423 million in 2Q. Now it’s clear they are on track for $400-$440 million in 1Q, which at the mid-point means they are essentially getting to the second-quarter target a full quarter early.

It’s noteworthy that the fourth-quarter call on February 23 was almost 8 weeks into the 13 week quarter. One would think they would have had a pretty good idea that non-GAAP SG&A was shaping up be in that range a full quarter sooner than they expressed. If so, what motivated them to be that conservative with SG&A guidance? One might think a company in Carvana’s position might be incentivized to talk things up to try to get the stock up due to the potential for reflexivity. But the opposite seems to have occurred. There were no disclosed insider buys after this call, so being conservative ahead of insider buying doesn’t seem to have been the reason. Were they hoping to keep a lid on the bond prices so creditors would be more receptive to an exchange offer at a premium? That might be the best explanation.

On adjusted EBITDA:

This is the highlight. Previously, consensus adjusted EBITDA was -$604 million for 2023, including -$204 million for the first quarter.

Doing -$50 million to -$100 million in the first quarter will crush that. More importantly, it positions Carvana well to be near breakeven on an adjusted EBITDA basis in the second quarter and likely profitable on that basis by the third quarter as long as industry demand remains more or less stable. After all, the headwinds facing non-GAAP GPU relating to inventory size and age will have diminished (confirmed by alt data), some or all of the deferred loan sales will be sold, and management is not done reducing SG&A.

Oddly, sell-side consensus estimates have not improved that much from this news. As you can see here, consensus is still at -$154 million for the first quarter and -$453 million for the year.

Again, I expect near breakeven adjusted EBITDA in 2Q and positive by 3Q. It’s a pretty big disconnect. Look at the consensus estimates, which doesn’t have positive adjusted EBITDA occurring until the first quarter of 2025. What is going on?

These Bloomberg estimates are adjusted EBITDA numbers, not EBITDA, so this is apples to apples. I think the disconnect is the sell-side has basically no incentive to turn bullish on CVNA at this point. From a 10,000 foot view, things are bad and the stock is in the toilet. Their peers are negative on the stock. The bonds are trading at big discounts. The short interest is sky high at 43.7% and an even higher percentage of the true float. Those are a lot of the people they talk to on a day to day basis and who pay them commission dollars. What’s in it for analysts to stick their neck out and turn bullish at this point? Not much. Maybe some raised eyebrows at best. It’s also safer for a sell-side analyst and his or her career to be wrong in a group than risk being embarrassingly wrong on your own.

As far as the estimates, I think this is a case where if an analyst takes management’s first-quarter guidance at face value, he or she would probably have the most bullish numbers on the street. That would be undesirable given the analyst likely wants to maintain their Sell rating and/or justify having just pulled their price target entirely. And having worked on the sell-side in another life, sell-side analysts tend to pick a rating and a conclusion first and then find reasons to justify it. Obviously, that is the opposite of truth-seeking and reaching conclusions based on first principles, but that’s the way the sausage tends to be made. So for now, consensus is still sitting at -$453 million for this year when it’s much more likely to be -$100 million or better and actually turning positive pretty soon. I think as a group the sell-side is unlikely to meaningfully raise estimates, ratings, and price targets until the stock market forces them to.

Even with turning adjusted EBITDA profitable this year, Carvana won’t be out of the woods because there’s still ~$600 million of annual interest expense to deal with. But once non-GAAP GPU exceeds non-GAAP SG&A per unit (“positive unit economics” as management has referred to it), they are likely to begin leaning back into advertising and inventory selection to start increasing retail units. Slashing both has been a meaningful headwind on units lately, so reversing that should be a tailwind at some point. That would help adjusted EBITDA get to meaningful levels where it can start to offset some of the interest expense burden. But the business can certainly use some help with that, which is where the debt exchange comes in.

Debt Exchange Offer

Carvana is offering to exchange existing notes for up to $1 billion principal value of new 9.0%/12.0% Cash/PIK Toggle Senior Secured Second Lien Notes due 2028. These initially yield 9% and Carvana has the option to defer the cash interest payments for the first three years in exchange for additional notes at a rate of 12%. After three years at most, the 9% cash interest payments return.

The offer is for up to $1 billion of new notes and the minimum is $500 million. Exchanged notes will be accepted on a priority basis as listed here:

The big issue is the noteholder cooperation agreement where a large group of noteholders has agreed to act together and cooperate in any negotiation with the company. Press reports suggest that group represents 70%-80% or more of the notes. Are there enough of the 2025 notes or others that are not part of the group that would be interested in exchanging? We’ll know soon enough because the deadline to receive the early exchange premium is next Tuesday, April 4th.

As a holder of the unsecured 2025 notes, would you rather get 5.625% interest for another two years and, assuming these are money good, your full principal back in 2025, keeping in mind these were trading at ~$0.52 on the dollar last week? Or do you take the premium now (a 19% haircut to your principal), get new secured notes that will either pay you 9% cash interest for 5 years or no cash interest for up to three years in exchange for growing the principal value of the notes 12% for three years before then getting 9% cash interest per year until 2028?

Exhibit 1 shows the math. In all likelihood, you’d be swapping near-term cash flows in favor of larger longer-term cash flows. For the new 2028 Notes, exchanging early gets us $808.75 of principal value as you can see in the screenshot above. If Carvana opts for full PIK option, that principal will turn into $1,136.24 after three years at which point 9% cash interest payments would begin on the new higher balance.

Exchanging looks like a 5.5% IRR. That’s a very modest benefit but you’re also swapping unsecured notes for secured and jumping ahead of the other unsecured creditors in the totem pole. That would be helpful in a downside scenario, so all together exchanging seems like a reasonable decision.

Another factor to consider is whether arbs are motivated to buy enough of these notes before Tuesday, exchange them at a premium, and then flip them for a quick profit. The extent of the profit would depend where the new notes trade. But given the 2025 notes have traded up from around $0.50 on the dollar to around $0.66 as of this writing while none of the other bonds have moved up seems to suggest some chance of a successful exchange offer involving the 2025 notes.

A lot of different things could happen though. Maybe they can’t issue $500 million of new notes but change the terms so they’ll do $300 million. Or maybe existing noteholders realize there’s interest and it splinters the cooperative group because no one wants to be left behind and see others leapfrog them in the capital structure, resulting in a larger exchange. Or maybe the Garcias or Mark Walter buy some of the 2025 notes and exchange them. Or maybe the one or both parties buy new debt backed by the ADESA real estate, which management just carved out. Carvana uses some of that cash to extend its liquidity runway further, giving it ample time to turn free cash flow positive, and/or maybe it repurchases some of its own debt at a discount. Maybe turning adjusted EBITDA profitable causes the stock to trade up enough such that management can issue some stock. I’m not sure what’s going to happen, but it feels to me like Carvana has some options and is in a relatively decent position, especially as it improves its core profitability.

Big Picture

Preliminary first-quarter guidance suggests Carvana is on track to be more or less adjusted EBITDA breakeven in 2Q and probably profitable in 3Q. From there it will probably begin to carefully remove some of the self-inflicted demand headwinds like slashing inventory selection and advertising. Reversing those headwinds should improve retail units. And maybe there is some relief on used car prices and/or rates. The 2-year, which Carvana bases its rates on, is down 100 bps over the last few weeks, which should theoretically put downward pressure on prospective car payments.

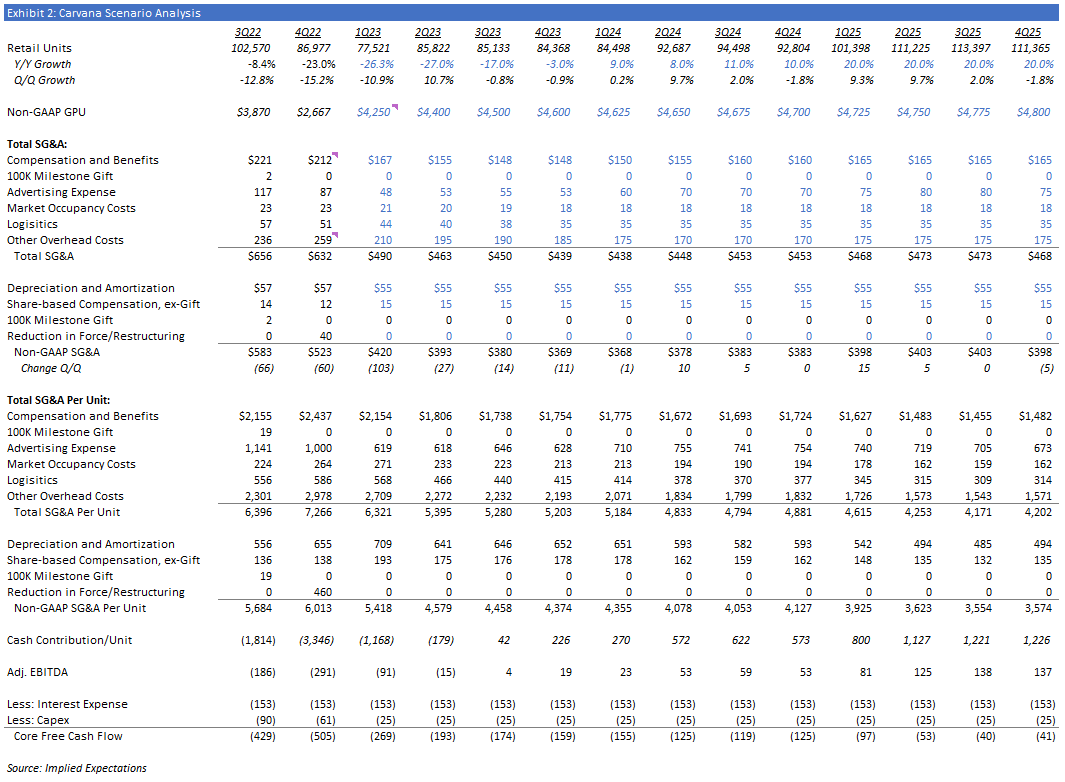

Here is my updated model for the next several quarters.

As you can see, I have adjusted EBITDA of -$91 million, -$15 million, $4 million, and $19 million in the four quarters of this year, respectively. You can compare them to the Bloomberg screenshot above. Previously, I had -$106 million, -$37 million, -$11 million, and -$9 million, respectively, which were already significantly better than consensus.

As you can see, even with positive EBITDA Carvana should still be burning some cash for a while due to the interest expense. But like I wrote, I think it has some options to address that. Positive adjusted EBITDA will help the cash burn while also giving equity investors a reason for optimism, which might give management a high enough stock price to use to improve the balance sheet with acceptable levels of dilution. We’ll see.

I continue to think the equity market is far too negative on Carvana, which looks to me to have much better odds of getting to the other side of this reasonably intact than the market seems to think. Having EGII and Mark Walter, both billionaires, as large shareholders since the origin of the business also increases optionality, in my view. And like I said in my last post, this is either a -1x or a 10x or 20x on a long enough timeline. For me, some position size is warranted, especially given my view of the odds.

If you have any questions, comments, or feedback on this post, I’d love to hear it. If you think I’m wrong about anything, I’d be grateful to hear it. Also, I know some of you are meaningful shareholders who might have interesting insights. You can shoot me an e-mail at impliedexpectations@gmail.com.

Disclosure: Long CVNA

Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.

Thank you for the article. I was wondering if you can help summarize the type of risks CVNA is taking with the increasing loans held for sale? Like quantitatively what would be worst case impact of these loans?