Carvana: Groupthink

Is it right?

Carvana reported its fourth quarter results last week. Here’s Ernie’s shareholder letter.

I was about to write that Carvana is a super controversial stock, but that implies it’s hotly debated among the bulls and bears. I don’t really see that. Most seem to assume Carvana is going to declare bankruptcy shortly and any bulls that remain are in hiding. When sentiment gets that one-sided, I think it’s worth taking a close look while trying to be objective. Because if sentiment happens to be plagued by groupthink, flawed analysis, or little analysis at all, and things end up ok, that’s how career-defining investments are possible. Or sentiment could turn out absolutely correct, even if a lot of it hasn’t been thoughtfully considered, leading to a total loss. Interested? Read on.

Liquidity Picture

In case it is unclear, it should be stated upfront that Carvana is not declaring bankruptcy imminently. They still have a good amount of immediately available liquidity as you can see here.

There are certain minimum restricted cash requirements that currently reduce true liquidity to some extent. But there’s also another more than $2 billion of unpledged real estate assets and beneficial interests in securitizations that could likely be monetized if or when necessary. And management is moving as fast as possible to cut costs and improve profitability to minimize cash burn.

4Q Review

Retail units declined 23.0% year-over-year and 15.2% sequentially. That was expected given the well-known alternative data that’s out there. The decline was driven by industry units being down about 12% sequentially—the ongoing impact of high used car prices and high auto loan rates on vehicle affordability—on top of Carvana’s self-imposed profitability initiatives, which include dramatically reducing inventory, which hurts selection and therefore sales conversion, slashing advertising spending, and generally prioritizing the most profitable sales at the expense of less profitable or unprofitable sales. Being only 320 bps worse than the industry on a sequential basis despite these self-imposed headwinds actually seems not terrible.

The company cut quarterly cash SG&A excluding restructuring expense, now renamed Non-GAAP SG&A, by another $60 million sequentially. I would have rather seen $70 million, but $60 million was more or less what I expected. This has now declined by $137 million in three quarters between 1Q22 and 4Q22 with more expected to come.

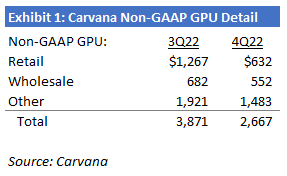

The biggest surprise was a much bigger sequential decline in cash GPU, now renamed Non-GAAP GPU, which fell from $3,870 to $2,667.

Virtually all of that shortfall is explained by two non-recurring items. First, Carvana’s large excess inventory coupled with the deflationary environment caused unusually large retail and wholesale vehicle write-downs. That accounted for $701 of the $1,203 sequential decline in Non-GAAP GPU. Second, a large block of loan sales to Ally was pushed from 4Q into 1Q due to the imminent renewal of the forward flow agreement in January, which reduced Other GPU by $483. Excluding these unusual factors, 4Q non-GAAP GPU would have been closer to $3,751. I had previously guessed it would be $3,700. So overall, the quarter was as expected normalizing for the unusual and timing items in 4Q.

The stock initially declined 21% the day after the report, but has since recovered.

Three Steps

Management framed their mission in three steps. First, get to adjusted EBITDA breakeven. Second, get to substantially positive unit economics where adjusted EBITDA is meaningful. Third, start to turn growth back on likely by accelerating inventory buying and advertising again.

They are still clearly in step one, but as you’ll read below, I’m not sure it’s crazy that they could achieve step one later this year. If that’s right, then step two is probably a 2024 event. And step three probably begins towards the end of 2024 or in 2025.

Looking Forward to 1Q

On 1Q retail units, we know a few things.

Management said 1Q should see a sequential decline from 4Q’s 86,977 retail units.

They expect “weekly retail unit sales volume to stabilize relative to the retail unit sales declines we saw in the second half of 2022 as the seasonal headwinds we faced in the second half transition to seasonal tailwinds.” What does that mean? Well, weekly retail units declined 15.6% year-over-year on average during the second half. In 3Q and 4Q, the declines were -8.4% and -23.0%, respectively. In December the declines were over -30%. I’m going to assume this means they don’t expect 1Q and 2Q to be worse than -25% year-over-year. That would imply about 79,000 and 88,000 units, respectively. 2Q should get a seasonal bump of some size given the seasonality driven by tax refund season, although it will be more muted than prior years.

They also said the first seven weeks of 1Q averaged 5,600 retail units per week, which is a 24.7% year-over-year decline on average. March tends to be the start of tax refund season, but again, expect a more muted increase than usual due to Carvana’s profitability initiatives, including cutting back inventory and advertising. If the last six weeks of the quarter average ~6,633 units, they would hit the -25% year-over-year figure.

On retail and wholesale GPU, 1Q should have minimal, if any, write-downs given the inventory was marked at the lower of cost or net realizable value at 12/31/22. So I think we can add back $598 and $103 to Non-GAAP Retail GPU and Non-GAAP Wholesale GPU, respectively, which would suggest $1,230 of Non-GAAP Retail GPU and $655 of Non-GAAP Wholesale GPU, all else equal.

On Other GPU, the loan sales were pushed into 1Q, which should occur on top of loan sales that would have happened anyway, so Other GPU should see an unusually large increase. You can see the inflated backlog of loans held for sale here:

If Carvana sells ~79k retail units and loan originations are ~72% of used vehicle sales, which is fairly typical, they’ll originate about $1.3-$1.4 billion of new loans in 1Q. Add that to the $1.334 billion loans held for sale at the end of the year, and there would be $2.6-$2.7 billion of loans to sell. They usually have something like $400 million of loans held for sale on the books each quarter, so it’s possible they could sell something like $2.2-$2.3 billion of loans in 1Q. If they make a 7% gain on sale, that would be something like a $157 million gain on sale. Finance GPU could be something like $2,100-$2,200 in 1Q, which seems higher than it’s ever been and sharply higher than 4Q’s ~$800.

Finally, making a reasonable assumption for non-Finance Other GPU, it seems like total Other GPU could be $2,700-$2,800 in 1Q if they sell the loans down to $400 million. That’s pretty huge, but again would not be repeatable in 2Q.

On the other hand, maybe they don’t sell the loans down to $400 million in 1Q. Maybe they sell them down to $600 million, leaving a little extra in the tank for 2Q. In that case, Finance GPU might be something like $2,000 in 1Q, still very strong. Total Other GPU might be closer to the $2,600-$2,700 range. That would still be the highest quarterly Other GPU ever.

So overall, 1Q non-GAAP GPU might look something like:

Obviously, there are other moving factors as well but I think I’ve captured the largest ones.

Looking Forward to 2Q

If retail units are -25% year-over-year again, that would imply 88,000 units, up from my estimated 79,000 in 1Q. Tax refund season usually sees a sequential increase.

Retail GPU should finally start to see benefits from bringing inventory down in line with sales. That leads to younger cars, faster turn times, and lower depreciation per unit. Management called this a $600 opportunity to GPU. I’ll say they get this evenly over 2Q and 3Q. I’m also going to estimate another $100 in gains from efficiencies. So 2Q Retail GPU would go to $1,630.

I’m going to guess Wholesale GPU at $675, not far from 1Q.

On Other GPU, they might originate and sell about $1.5 billion of loans. That might lead to around $1,300 of Finance GPU and maybe $2,000 of total Other GPU.

Or, in the alternative scenario where they leave more loans in the tank to sell in 2Q, maybe they originate $1.5 billion and sell $1.7 billion, leaving them with $400 million at quarter-end. Finance GPU might be closer to $1,400-$1,500 and total Other GPU maybe $2,100-$2,200.

SG&A

My take on SG&A is simple. Management expects to achieve $100 million lower Non-GAAP SG&A over the next two quarters. So the $523 million in 4Q would go to $423 million in 2Q. I assume $55 million is realized in 1Q and another $45 million in 2Q. Gains are expected across all SG&A expense buckets.

Bridge to Adjusted EBITDA

In Exhibit 4, I put it all together. For 1Q and 2Q, I use the average of my Non-GAAP GPU estimates from Exhibits 2 and 3 above and the SG&A assumptions above. For 3Q and 4Q, I expect further incremental progress on GPU and SG&A per unit, which would get Carvana to more or less breakeven on an adjusted EBITDA basis later this year. As you can see, that would be wildly better than consensus expectations.

If that, or something in that ballpark, were to play out I’d expect sentiment to go from “certain bankruptcy within quarters” to “these guys might actually have a shot.” The stock would likely perform well, especially given the super high short interest.

A higher stock price could provide more optionality for management. If necessary or desirable, they could potentially use their higher stock price to initiative a partial debt-for-equity swap. Or they could even issue a little equity if the price is right. It’s possible they could more easily monetize some of their unpledged real estate, extending their runway and improving their flexibility. Doing any of those things could help get the business over their interest expense hump and closer to sustainably free cash flow positive. Or maybe management will think they don’t need to do any of those things.

Writing all this sounds like heresy today. But if it’s anywhere in the ballpark, I’d expect CVNA shareholders to make many, many multiples on their money from here over time. First, from getting to “these guys might actually have a shot” sentiment and then to “these guys are going to make it, they’re going to turn growth back on, and they’ll be the leanest, most efficient they’ve ever been while still only having ~1% share in a 40 million unit market.”

On the other hand, this could be completely wrong. Maybe the 2-year goes higher and higher, making auto loans even less affordable, pressuring retail units. Maybe we enter a nasty recession. Carvana would have to cut expenses even more, possibly cutting muscle. Maybe the business falls apart and management can’t raise capital or monetize unpledged real estate even from their two billionaire shareholders who have tons of equity on the line and have been involved since the beginning or close to it. In that case, well, the most you can lose is 100%.

More Detailed Model

Here’s a more detailed model showing some longer term assumptions and including the SG&A detail. Obviously, the future is uncertain. But this is one possibility.

For those newer to Carvana, there are a lot of numbers here. But they all build up to the three key drivers that will determine the liquidity path: retail units, Non-GAAP GPU, and Non-GAAP SG&A.

Retail units * (Non-GAAP GPU - Non-GAAP SG&A Per Unit) = Adjusted EBITDA. And from there interest expense and capex is the next hurdle to overcome.

Big Picture

It seems very likely that 4Q was the trough for the business. Non-GAAP GPU looks certain to improve sharply. Non-GAAP SG&A looks like a lock to continue to fall sharply. Retail units are more uncertain but seem to have stabilized on a weekly basis and should tick up seasonally very soon. That means, for the first time, we’ll see stabilizing units on top of large SG&A cuts, which is how SG&A per unit will finally fall meaningfully. So I’m not sure how we don’t see a huge improvement in adjusted EBITDA in the coming quarters. And much more so than the market expects (see Exhibit 4).

Obviously, even if that’s true there will still be a high interest expense hurdle to overcome. But I think getting to adjusted EBITDA breakeven or better, and faster than the market expects, could go a long way in providing a reflexive dynamic where a higher stock price leads to more optionality and potentially enables balance sheet improvements. That would help get Carvana out of the woods, leading to a still higher stock price.

What could Carvana look like by 2024 or 2025 if this plays out? I don’t think it will be the old Carvana. The business has made significant strides in underlying efficiency, which it simply did not prioritize when in all-out growth mode in the past. For example, average delivery times are down 25% since early last 2022. There are now scheduling systems that allow the business to pair over one out of three deliveries with a pick-up, which is up from one out of 14 one year ago. Customer care advocates are spending 40% less time on the phone per sale compared to early 2022. 40% of customers are now picking up their cars at vending machines, which reduces variable fulfillment costs. That’s up from 20% a year ago. These are the types of things that are easy to gloss over in the short-term because everyone is focused on the stock and the company’s liquidity, but should enable the leanest and most efficient Carvana we have ever seen on the other side of this.

That’s interesting because Carvana had been substantially adjusted EBITDA profitable in its five oldest annual cohorts in 2021. And it’s two oldest annual cohorts almost reached the low end of the company’s long-term target profitability range. That was certainly aided by an appreciating vehicle environment at the time, but it was also while investing ahead of ~50% expected demand growth and before any of their efficiency initiatives were implemented.

But we’ll see. I’ve been wrong before. But to me, this is either -1x or +10x or +20x and more on a long enough timeline. With the probabilities I assign, this seems attractive, but you should assign your own.

Disclosure: Long CVNA

Disclaimer: Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.