I’m going to make this post shorter than usual because I think the trajectory Peloton is on is now much clearer. And I have new companies to study and write about.

Peloton reported its fiscal second quarter last week. Barry’s shareholder letter is must-read as always.

To me, the biggest news is Peloton was free cash flow positive excluding stock-based compensation and excluding non-recurring supplier settlement payments. On that basis, free cash flow was $8 million in the quarter. Of course, SBC is a real economic expense and should be included as an expense when considering earnings and valuation. But it is not relevant when evaluating a company’s liquidity given it is non-cash. The supplier settlement payments extricate Peloton from unneeded inventory commitments that prior management made when it got carried away by dreams of runaway demand as far as they eye can see.

The second biggest news is there were 60k net adds in the Connected Fitness business. That was much higher than management’s guidance for 27k, which they essentially told us was conservative at the time. I wrote in Peloton: Retethering (Nov 2022):

Big picture, I have been saying for a while that when Peloton can show it is a) free cash flow positive and clearly self-funding, and b) still growing its subscriber base sentiment towards the stock and its market valuation should improve. Here’s how I phrased it in Peloton: Retethering:

Show Me

It’s interesting to me how clear it was that Peloton was on this path towards cash flow breakeven yet the market refused to give it any credit until this quarter. It needed more evidence. It had to see it to believe it. The market, of course, is made up of lots of individuals who have that mentality. I’m not saying that’s some shortcoming. In fact, it wouldn’t be hard to argue it’s the better way to invest. Lots of us have visions of the future that don’t pan out sometimes (Stitch Fix anyone?). And as a friend pointed out, Buffett almost exclusively invests in companies that have long track records of profits. While there may be exceptions, he’s almost always unwilling to bet on a vision that calls for the status quo changing in some way. He likes investing in chewing gum, for example.

That makes me think about what distinguishes us as investors. It isn’t whether we are seeking “value” or “growth.” Growth is one component of value. Everyone wants value. Everyone wants to buy something for less than it’s worth whether it’s growing quickly or not. The real difference between us could be the extent to which we are willing to look into the future and believe in and bet on something that hasn’t happened, is yet to fully play out, or is to some extent unproven. Some will call that speculation but there is a difference between pure speculation and well-informed speculation. Obviously, either can end up wrong or right. But this may be why poker players have the potential to be good investors—they are comfortable betting on outcomes based on probabilities while having imperfect information.

Spotify’s gross margins come to mind. Daniel Ek and Paul Vogel can say “gross margins are going to improve” until they are blue in the face. They can show us how the flat reported gross margins over the last few years are really a function of nicely improving music margins offset by huge podcast investments that will moderate and scale. But the market largely yawns. It will believe it when it sees it. It is a show me story.

In Peloton’s case, the market would believe “self-funding and growing” when it saw it. Until then, it would be a coat rack company with an iPad attached to it with a stock that was going to zero. I would say we are starting to move off the latter characterization but we are not close to the former yet. Skeptics can still point to all sorts of negatives—still negative hardware gross margins, still too much inventory, tried and failed to sell Precor, churn a bit higher than it used to be, the company is no longer disclosing engagement metrics, declining digital app subscribers, and I could go on. I’d argue thus far each of those are either temporary or immaterial.

Where are you on the spectrum of being a “show me” investor or a “bet on the status quo” investor versus a “willing to bet on what I haven’t been shown yet” investor?

Building a Statue

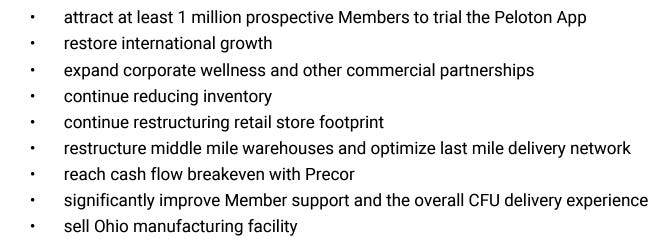

A contributing factor to how few seemed to believe in Peloton’s trajectory may be the underappreciation of Barry McCarthy and his skill set. I said from the day he was hired that he was the ideal CEO to lead Peloton at that moment. Look at what the business has accomplished in one year under his leadership.

And what he has planned for Year Two:

Shareholders should build a statue for Barry outside Peloton HQ. I would say the chances of bankruptcy or a massively dilutive equity raise were very high before he took over. Prior management didn’t have their arms around much. They didn’t even understand how much inventory that had committed to ordering from suppliers. It was a mess. Barry was “stunned” at the size of the company’s litigation expenses when he walked in the door among other things. They had 9k employees and were vertically integrated, doing everything from owned manufacturing to their own delivery and installation to their own showrooms. Peloton has exited the first two and is on its way to exiting a substantial number of showrooms, which makes sense given their generally low returns and the new Amazon and Dick’s partnerships.

I’ll update my Peloton scenarios and valuation in a future post. Expect more posts about new companies this year. Suggestions welcome.

Disclosure: Long PTON

Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.

Great work here IE, keep it up!