Peloton: Opportunistic

Growing subs 120k this year despite cutting media spend $292m YTD, about to ramp marketing and launch a tiered app, and an exec being opportunistic at an all-time low stock price

Peloton reported its fiscal third quarter on May 4th. Here’s Barry’s shareholder letter, which is always a must-read. Here’s how he opened it:

This quarter showed continued progress on cost cutting, growth, and planting seeds for potential future growth. Underlying operating expenses excluding restructuring and impairment charges, supplier settlements, and the accrual of a one-time $75 million payment to DISH to settle a patent dispute fell to $407 million in the quarter. That is down from a peak of $697 million five quarters earlier. That is solid progress and there are more cuts to come.

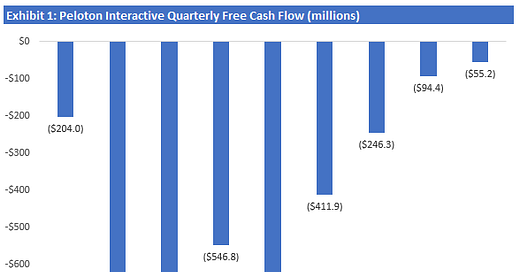

Free Cash Flow

Barry’s number one priority has been getting to free cash flow breakeven. Free cash flow improved to -$55.3 million this quarter, a continuation of the steady improvement since Barry took over one year ago.

Excluding $18.5 million of supplier settlement payments—which are expected to fall to $3 million in the current quarter and then stop—and the $19.1 million civil penalty from prior management’s blunder handling the Tread+ recall with the CPSC—another non-recurring item—free cash flow would have improved even more to -$17.7 million. And even that included $21.9 million of cash payments for restructuring activities. So excluding all non-recurring items, Peloton was free cash flow positive this quarter.

Certainly, that is helped by the tailwind from working capital as the company sells down excess inventory over time. That was a $119 million source of cash during the quarter. And that source will diminish over the next 12 months as inventory comes more into balance. But that is a definitely a good thing as that will eliminate the excess storage costs that have been pressuring Connected Fitness gross margin. But it also means Peloton needs to continue growing gross profit and paring its operating expenses in order to become sustainably free cash flow positive without the benefit of working capital.

Of course, it is also helped by stock-based compensation, a non-cash expense but a real economic cost. But in this context, we are talking about free cash flow as it relates to liquidity, not free cash flow as it relates to valuation.

I should also point out the $75 million payment to DISH while accrued for this quarter will be paid in F4Q, which means free cash flow will take a temporary step back. But excluding that one-time item, they should be right there again despite it being the seasonally slowest quarter.

If anyone is still concerned about Peloton’s liquidity, I think that should be put to bed. The company will burn that $75 million DISH payment this quarter, but should be sustainably cash flow positive beyond that. EBIT is still negative but should continue improving due to subscription gross profit growth, Connected Fitness gross margins likely turning positive next year, and ongoing efficiency gains within opex, including closing most of the showrooms.

So I think we’ll still see negative EBIT in fiscal 2024 but adding back D&A net of capex, SBC, and the cash from inventory tailwind should create positive free cash flow for the year. There’s also the favorable working capital dynamics from the upcoming relaunch of the digital app, which will almost certainly offer an annual membership at a discount. If 200,000 existing digital app subscribers opt for the premium tier at an annual cost of $240, a discount from the rumored $24 per month price, that would generate $48 million of upfront cash flow. That’s the changing working capital dynamics Barry was referring to here:

I’m guessing we see EBIT turn positive during fiscal 2025. Peloton is also likely to sell what was once to become Peloton Output Park (“POP”) in Ohio sooner or later for perhaps $50 or $60 million. And Precor is likely to be sold sometime beyond that for maybe $300 million or more once they improve its financials.

In my opinion, long-term growth should be the bigger question mark than liquidity at this point.

Growth

On the growth side, Peloton reported 74k Connected Fitness paid net adds, again beating the guidance range of 47k-57k. That brought the Connected Fitness subscriber base to 3.11 million, up 4.9% year-over-year. It’s become clear Barry and Liz routinely guide on the conservative side. I continue to feel like most investors would be surprised to hear that Peloton has grown its subscriber base every single quarter even in the aftermath of the pandemic. Most would not guess that by looking at the stock chart or reading headlines.

However, management’s guidance for F4Q reflects its first ever decline for Connected Fitness subscribers, a 1% quarter-over-quarter decline to 3.08-3.09 million. I actually expected this guidance to be worse because a) it’s the seasonally weakest quarter of the year, b) Peloton only had 4k paid net adds in the year-ago quarter, and c) Barry guides conservatively. So the fact that guidance is only calling for a 1% decline makes me think we’re more likely to see a flattish or positive number.

Certainly, FaaS (the rental program) and PCR (Peloton Certified Refurbished) are helping growth. The two represented 24% of hardware sales last quarter and 62% of FaaS customers are incremental. Amazon is helping as well and Peloton will participate in its first ever Prime Day, likely in July, which could potentially drive some unseasonal strength in F1Q (Sept).

Management is also launching a media campaign later in May yet is not baking in any upside from this media campaign into guidance. Here’s Liz on the call:

I could be wrong, but it would seem unusual to increase media spending quarter-over-quarter for a brand relaunch campaign and not see any uplift in unit sales. We’ll see.

Growth Seeds

I think it’s clear one of Barry’s main goals is to maximize monetization of the content that Peloton is already making. That’s the beauty of fixed cost content, which he is so familiar with from his days as Netflix’s CFO. They are already paying for the studios, the instructors, and the production of nicely produced classes across so many fitness modalities. The only meaningful variable costs that come with additional subscriber revenue are music royalties and streaming delivery costs, which together have averaged 20% or less of incremental subscription revenue for the last couple years. In other words, 80% or maybe a bit more of additional subscription revenue should be able to drop to to gross profit.

That’s where the relaunch of the digital app comes in. How does Peloton better monetize the app to drive more of that super high incremental margin revenue? In theory, the ability to use the app without the requirement of buying Peloton hardware should expand the TAM of people who would consider using it. Thus far, that hasn’t really been the case. Digital app subs peaked just below 1 million and has been languishing there. Management says the product is loved—it has the highest NPS of any Peloton product—but the very low 5% unaided awareness is the problem.

Management’s idea is to relaunch it in three tiers instead of having a one-size-fits-all app offering. One tier will be free with just enough classes to give you a taste. That is designed to widen the top of the funnel without any friction from price. The next tier should be something like $12.99 per month, the existing app price, and should have more content but not all of it. And the premium tier appears to cost $24 per month and will have all the content and maybe other perks. And by all accounts it should have the ability to pay for a year for $240, which is effectively giving away two months for free.

Management has said that about half of digital subs are using bike and tread classes, which must be happening on third-party hardware. It remains to be seen how many of them stick with the offering and pay $20-$24 per month for the premium tier, how many stick with the $12.99 price point and seemingly settle for less content, and how many drop to the free tier or no tier. But there are certainly power users of the app who will pay more, but we’ll see how many. One would think the free tier will attract some new users because free is pretty cheap.

In Barry’s F2Q23 shareholder letter, he wrote a list of his goals for his second year in charge.

That seems like a healthy goal. I think the plan is to target gym goers. At least pre-pandemic, there were an estimated 180 million gym memberships across the U.S., Canada, the U.K., and Germany. Some of those people might benefit from having Peloton content on their phones while on treadmills, bikes, rowing machines, or lifting weights. Bob Treemore on Twitter shared this screenshot of “Peloton Gym,” which may be part of the app relaunch.

What’s interesting is how different Barry’s approach is versus co-founder and prior CEO John Foley’s. John was concerned the digital app would cannibalize the Connected Fitness offering so they didn’t really market it, which helps explain the low awareness. He didn’t want to encourage people to use their content on third-party hardware because that could have been a Connected Fitness sub. He thought all fitness was moving into the home and that the brick ‘n mortar gym was dying.

In contrast, Barry recognizes that not everyone is going to be a Connected Fitness sub. Gyms don’t work for a lot of people—just look at gym churn rates—but they do work for some. And they aren’t going away. Why not market the Peloton app to those people since it is content they’re already making anyway? Peloton should generate more high-margin revenue while also introducing more people to the great content, which could lead some of them to the Connected Fitness offering. Basically, Barry wants to sell Peloton content to everyone everywhere they want it.

We’ll see if it works. It might or it might not. I have concerns. While the Peloton content is the best fitness content available by far, the real magic of Peloton is the hardware/software/content interactivity of the full Peloton experience. Seeing your on-screen metrics spike, seeing you surge past others on the leaderboard, seeing you closing in on your prior record is a really compelling, differentiated experience. You don’t get the same interactivity with just watching the content on the app that’s not tied into the hardware. So while the app certainly offers great content, it does not offer the “wow” experience of the full blown Connected Fitness offering. Is there a risk that cohorts of upcoming app trialers associate Peloton with good/fine content but not with the more compelling interactive experience that most Connected Fitness subs understand and appreciate? I don’t know.

Marketing Efficiency

Management pointed out that LTV/CAC was over 2 this quarter. That’s up from 1.4x cited in the prior quarter, which sounded more concerning. What’s interesting to me is that this almost certainly can increase over time. Why? Well, LTV seems below its steady state level because Connected Fitness gross margin is still negative due to temporary factors like excess storage costs and middle mile inefficiencies that should be addressed. There is no reason selling exercise hardware, apparel, and accessories is a negative gross margin business at a steady state, which would imply exercise equipment would not exist because no one would make it. Peloton is clearly going to make money on the hardware once it finishes addressing some remaining issues and finishes selling higher cost inventory. And CAC seems overstated because there is still a massive fleet of 90 or so showrooms, most of which are relatively unproductive and will be closing over the next 12-18 months. Not burdening sales and marketing expenses with the better part of $100 million of showroom fixed costs—showrooms that drive a tiny fraction of incremental unit sales—should reduce CAC over time.

Recall News

Last week, Peloton issued a recall of the original Bike. The stock fell 9% on the day and hasn’t meaningfully recovered. That strikes me as a severe overreaction to news that is barely newsworthy. This is not like the Tread+ recall where a child died and Peloton had to offer full refunds. In this case, there were 35 reports out of 2.2 million Bikes where the seat post broke or malfunctioned. Peloton is offering a free replacement seat post that you can self-install. There are no refunds being offered.

This is really a non-issue, in my opinion. Part recalls are notorious for their low participation rates. Management reserved $8.4 million as their initial guess at the future cost of these seat posts and shipping costs. That may change over time, but this is immaterial. I’m not going to predict that the stock will snap back to $8 or $9 as the market digests this news—who knows what the stock does. But it would deserve to.

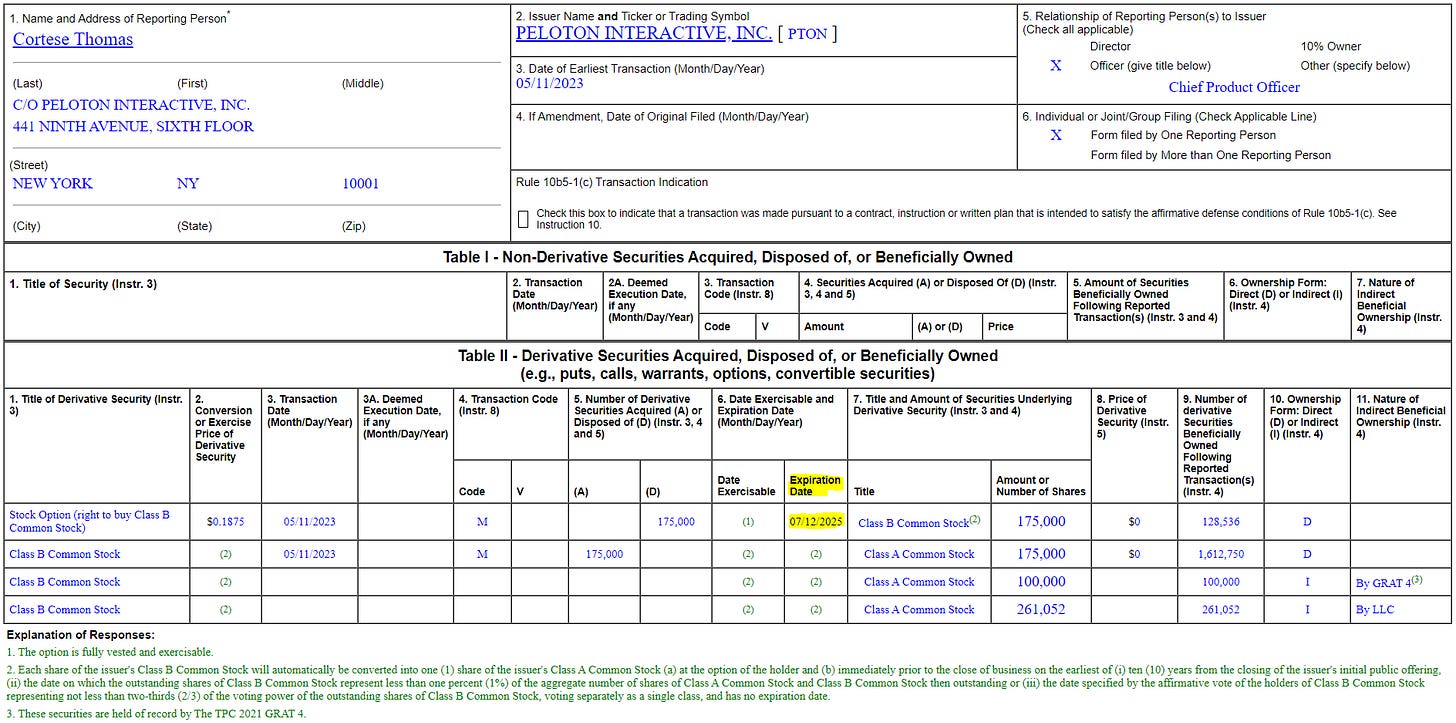

Cortese’s Early Exercise of Options

Yesterday, Peloton filed a Form 4 showing co-founder and Chief Product Officer Thomas Cortese exercised 175,000 options.

Most Form 4s about option transactions don’t offer a strong signal one way or another about how an executive views the stock. But what’s interesting about this one is these options don’t expire until July of 2025. By exercising early, Cortese chose to pay almost $33,000 for these shares. That’s the $0.1875 exercise price times 175,000 options. He also voluntarily realized a taxable event because the difference between the current share price and the exercise price times the number of shares is taxable income. In this case, he exercised them on May 11th, the day the recall news broke that sent the stock down 9%. So let’s use the closing price on that day of $6.86 per share. His taxable income would be ($6.86 - $0.1875) x 175,000, which is $1.2 million.

Why would he do this over two years before expiration when he could have just waited until just before expiration, kept his cash invested or earning interest, and deferred the tax liability for another two years?

The most likely reason is because he views $6.86 as a low point for the stock. He is being opportunistic. By exercising early when the stock is $6.86, he minimizes the taxable income realized in contrast with exercising in 2025 if the stock is much higher. Let’s say the stock is $30 then and he exercises them. That would be taxable income of ($30 - $0.1875) * 175,000, which is $5.2 million. Would he rather owe the taxes on $1.2 million today or the taxes on $5.2 million in two years? That’s why executives exercise options early.

Opportunistic Price

I agree with Cortese that ~$7 is a highly opportunistic price. First, it’s the lowest PTON has ever traded. That’s interesting considering Peloton’s fortunes arguably looked bleakest about 12 months ago when cash burn was through the roof, they didn’t even know how much inventory they had committed to buying, and growth at all looked highly uncertain. In contrast, since then cash burn has been reduced to almost nothing, notwithstanding the DISH payment, while Peloton has proven the ability to grow Connected Fitness subs by a respectable ~120k this fiscal year. And that’s despite temporarily slashing media spending $292 million year-over-year through 9 months of fiscal 2023 to reduce cash burn. One would think—and Barry seems to agree—that Peloton could grow faster if it were not spending so little on marketing. Overall, there is much less uncertainty about Peloton’s liquidity and its growth than there was a year ago.

Second, while we’re now in the seasonally weakest quarter, that should be the low for the business this year. For one thing, management plans to launch the major brand campaign and the new digital app offering later this month. Management baked in none of the upside from that despite a reasonable expectation there should be upside. Further, the usually slow F1Q quarter ending in September may not be quite so seasonally slow this year because Peloton will participate in its first ever Prime Day on Amazon (which will soon sell Bike+ in addition to Bike!). Further still, the company is leaning into FaaS and PCR bikes, which just accounted for 24% of sales while FaaS sales are 62% incremental. So there’s a chance the usual six months of seasonal softness over the summer could be cut short and better than expected this time around. And then we’re back into the seasonal strength of fall, winter, the holidays, and New Year’s resolutions.

Third, the stock is attractively priced as long as you think the offering is sustainable and slowly growing over time and that management will optimize the financials. I’ll post my updated valuation work shortly, but for now I’ll just point out that at $6.95 per share, the enterprise value is $3.3 billion. Even excluding the hardware business, which has a positive value, the Subscription revenue annual run-rate is $1.7 billion and growing. So the stock is at 1.9x EV/Subscription sales. This is a super-high margin business with ~80% incremental gross margins.

Disclosure: Long PTON

Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.

"Hi IE, What is meant with "incremental" below? Barry mentioned the same this week in the JPM conference. "Certainly, FaaS (the rental program) and PCR (Peloton Certified Refurbished) are helping growth. The two represented 24% of hardware sales last quarter and 62% of FaaS customers are incremental."