Peloton: Barry's Shifting Focus

"The luxury of a comfortable liquidity position and outlook"?

Peloton reported its fiscal fourth quarter results in late August. Here’s the press release, including Barry’s letter. Even if you have no intention of investing in Peloton, this saga is so interesting and, I think, valuable as a case study.

The key questions that I think should be on investors’ minds are:

“When will the business get back to profitability and cash flow breakeven?”

“Beyond that, how much growth is left for Peloton in the years to come?”

“Could the current cash burn and lack of meaningful sub growth mark the point of maximum investor pessimism?”

And ultimately, “Is Peloton at a $3.7 billion equity valuation an opportunity?”

So far, sentiment suggests the answer is “No” to the last question. Peloton is the poster child of the pandemic pull-forward demand boom and subsequent bust. Most investors point at the train wreck in the rear view mirror—it really is something to behold—without considering what may be coming and whether there could be an opportunity.

That’s understandable. Peloton reported another ugly quarter in a string of ugly quarters. The stock dropped 18.3% the day it reported F4Q results. The company burned another $411 million of cash, average monthly churn spiked to 1.41%, overall revenue tanked 28%, and the company will no longer be disclosing engagement metrics. The media narrative has taken on a life of its own—Peloton’s subscribers are leaving in droves and returning to gyms. The Peloton bike was a fad and most are now acting as coat hangers. One could argue this is more the result of narrative following price rather than an objective evaluation based on first principles.

As always, understanding what happened is only valuable to the extent it informs us about what’s to come. Equity value is the present value of all future, not past, cash flows. It can be interesting when investor sentiment reaches new lows or languishes near them while bad results start to get less bad. We could be there now.

There are a lot of moving pieces going on with Peloton, but the primary near-term goal has been getting back to cash flow breakeven. Doing that means management had to reduce inventory purchasing commitments, get gross profit up, and get operating expenses down.

In this post, I’ll go through each of those topics in some detail, how and why Barry is shifting his focus, the emerging initiatives he is now focused on, the spike in churn, operating leverage in the subscription business, headcount, Tread+, a thought experiment about pandemic beneficiaries, a variety of possible outcomes for Peloton and what they imply about valuation, and other topics.

Starting with Inventory Commitments

Prior management’s biggest mistake was assuming the pandemic-driven demand boom was sustainable. As a result, they committed to purchasing far too much inventory. That tied up well over $1 billion of cash when normalized inventory is closer to half that. Soon after Barry took over in February, he hired Andrew Rendich, a former colleague from Netflix, to fix Peloton’s supply chain problems.

The company’s filings show how these inventory commitments have changed over the last several months. The F2Q (December) 10-Q mentioned this $550 million figure.

Then the F3Q (March) 10-Q discussed how the obligations were between $120 million and $280 million, but there were also negotiated purchases in excess of the obligations that could range from $180 million to $470 million. Essentially, this split the $550 million from December into two components—a legal obligation and commitments made that were subject to negotiation. Obviously, the company couldn’t walk away from the latter without harming its relationships with its suppliers.

Then in the F4Q report and 10-K, Peloton reported $337.7 million of settlement agreements to terminate future inventory purchase commitments.

The company finally seems to have its arms around the inventory purchase obligations. While the “remainder” amount of cash will head out the door for this in FY23—$238.1 million—this appears to be manageable. On the call, Barry suggested this should be more than offset by cash coming in the door from sales of existing inventory this year. And then FY24 should see inventory as a sizable source of cash for the first time in the Barry era.

Gross Profit

On the subscription side, the company ended June with 2.966 million Connected Fitness subs. Guidance for the current quarter is flat. Naturally, that means in F1Q there should be an average of 2.966 million CF subs * $44 per month * 3 months = $391.5 million of All-Access revenue. This will be the first full quarter reflecting the $5 per month subscription price increase that was implemented June 1.

June ended with 980,000 digital app subs. While they don’t give guidance for this, I assume it remains flat. That means in F1Q an average of 0.98 million digital subs * $7.94 * 3 months = $23.3 million of revenue. [Note: If you’re wondering why I don’t assume the $12.99 per month rack rate, there are discounts for certain types of members (students, first responders, medical, teachers, and military, not to mention the corporate wellness program), so they net something less. I back into digital app ARPU each quarter with the disclosures they provide. I have it at $8.96 per month last year, including about $7.94 in the year-ago quarter. I assume it remains there.]

Between the All-Access subscription revenue and the digital app revenue, next quarter would have about $414.9 million of subscription revenue—an all-time high due to the growing sub business and the price increase.

Next, subscription gross profit. The incremental gross margin in the subscription business was 81% last quarter (more on this later). That’s another all-time high and driven by operating leverage, efficiencies in variable costs, and one month of the subscription price increase. Given the notable improvement in variable costs and the fact F1Q will be a full quarter with the price increase, I’m estimating the incremental margin is 84% this quarter. That implies F1Q subscription gross profit of $295.7 million, another all-time high. That’s up $93.0 million from the year-ago quarter.

The Connected Fitness hardware piece is another story. Consider management’s guidance for total revenue of $625 million to $650 million. Taking the mid-point of $637.5 million and subtracting $414.9 million of estimated subscription revenue implies $222.6 million of Connected Fitness revenue. That’s come down a long way from the last two “pandemic era” F1Qs, but is actually up 38% from the last “pre-pandemic” F1Q.

Management also gave guidance for an overall gross margin of about 35% this quarter. To get there with all the other variables discussed, the Connected Fitness gross margin needs to be something like -32%. That’s a still-ugly -$71.2 million of gross profit. The exit of owned manufacturing was announced during F1Q in July and similarly the exit of 1PL was announced in August, so that’s the main reasons F1Q is still bleeding on the hardware side. We should see Connected Fitness gross profit significantly improve in F2Q once we get a full quarter with those things off the books.

$295.7 million minus $71.2 million implies $224.5 million of total gross profit. That’s certainly an improvement over the last two quarters and higher than any pre-pandemic quarter of course. But this should be the lowest gross profit quarter in FY23 as hardware losses turn into profits throughout this year.

… And Operating Expenses

Management has made progress reducing operating expenses. The original target it gave in February was to reduce annual opex by $500 million. Their goal was to get to around $2 billion of opex in FY23. However, they seem ahead of schedule. Last quarter, opex, excluding restructuring-related charges, was $475.1 million, an annual run-rate of $1.9 billion. While that was a seasonally light quarter for advertising, it was also before the latest round of restructuring actions were taken. That included Peloton laying off roughly half of its member support teams earlier this month, including closing its Plano and Tempe offices. There were approximately 250 employees that were let go, according to the 10-K (Bloomberg reported 252). Member support expenses are in G&A.

Peloton is also likely to close a substantial number of its showrooms this year. On the call, Barry said he would like to close $50 million worth of showroom opex. Historically, less than 20% of unit sales come from the showroom and it is likely well below that bogey today so I think the writing is on the wall. After I bought my Bike online a few years ago, I was really surprised to learn the company had physical showrooms. While Barry hopes to be able to intelligently reinvest those savings into higher return marketing channels, this savings will still represent a reduction in fixed operating expenses that will free up resources and increase flexibility heading into FY24.

It is also possible that Precor may be sold. It is a non-core asset as Barry would define it, but it has been helpful for expanding Peloton’s commercial business, which grew revenue 35% last quarter. If they do decide to sell it, there is a good chunk of opex that would go away.

All things considered, it’s possible underlying opex can get down close to $1.9 billion or so this year and could drift lower to $1.8 billion in FY24. Most importantly, Barry and CFO Liz Coddington said a few times that they would continue to remove as much of the cost structure as necessary to align with the revenue run-rate, whatever that turns out to be.

Here’s Barry:

Here’s Liz, specifically saying they’ll cut as much as necessary to reach breakeven free cash flow by the second half of FY23 (June).

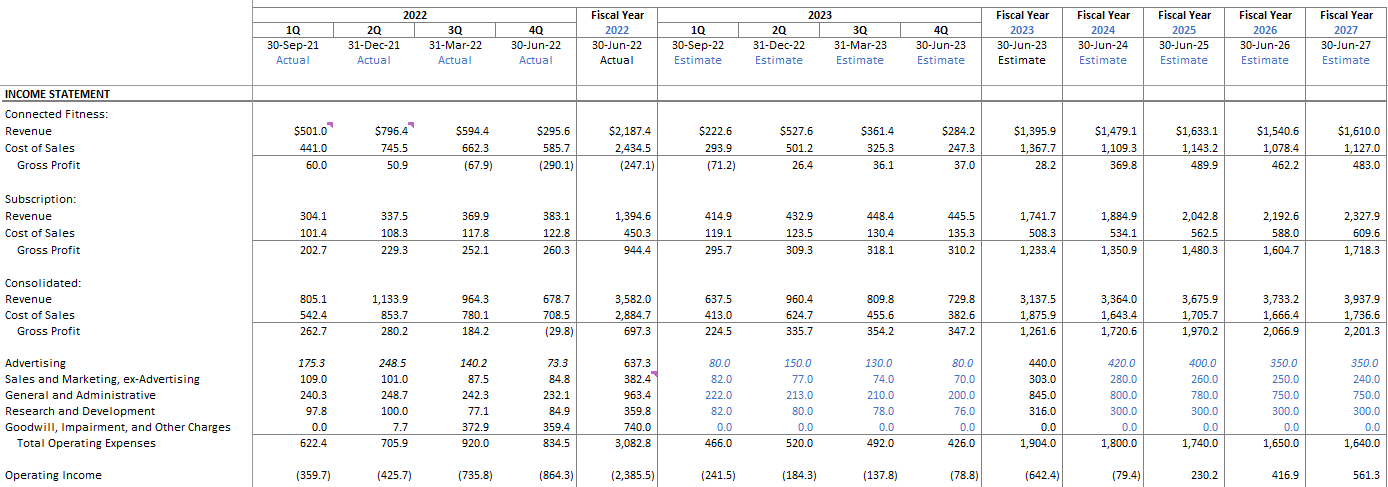

Here is one possibility of what the P&L could look like this year and over the next few years.

That compares to consensus EBIT of -$618 million, -$309 million, and -$194 million in FY23, FY24, and FY25, respectively.

Barry’s Shifting Focus from Cash Flow…

There has been a clear shift in Barry’s focus this quarter. If we go back to prior calls or interviews, it was clear his #1 focus was stabilizing cash flow. It had to be. Fail to do that for very long and the business would run out of cash and require an extremely costly equity raise. That would be a disaster at this depressed stock price.

Now, Barry has shifted his focus from cash flow to revenue growth and margin expansion. This is from his shareholder letter:

Why the shift? It’s clear he considers the cash flow problem solved. Of course, as an outsider, we don’t quite see that yet. Peloton burned $411 million of cash this quarter, which is still an abomination (although an improvement from the $747 million it burned in the prior quarter and the $656 million it has burned on average over the last four quarters). Most investors still see the $411 million of cash burn as far from a solved problem.

Barry knows the impact the recent moves will make on cash flow. Since the quarter ended, Peloton has exited all owned manufacturing and let go of 500 employees in Taiwan. It exited all first-party logistics in the U.S., closed warehouses, and let go of 530 delivery employees. It has let go of 250 employees in member support and closed the Plano and Tempe offices. These should be meaningful reductions to fixed costs.

As a result of some of those changes, Connected Fitness gross margin will probably turn positive in F2Q. Couple that with the subscription price hike, the improvement in variable subscription costs, and the upcoming seasonal strength for hardware sales and I think Barry sees where the puck is going.

Consider this comment he made on the call:

I think many investors would raise an eye brow hearing Peloton has the luxury of a comfortable liquidity position and outlook. Does that make sense? Well, here’s why he said that: