Naked Wines: The Pivot

Low expectations, an improving business, and insider buying

Naked Wines reported its 1H FY23 results and slides (ending September 26th) on December 7th. There wasn’t much surprising in this report because the company had reported most of the 1H detail as part of its operational and financial update on October 20th. And full-year guidance for every line item for fiscal 2023 and fiscal 2024 was unchanged from that given in October.

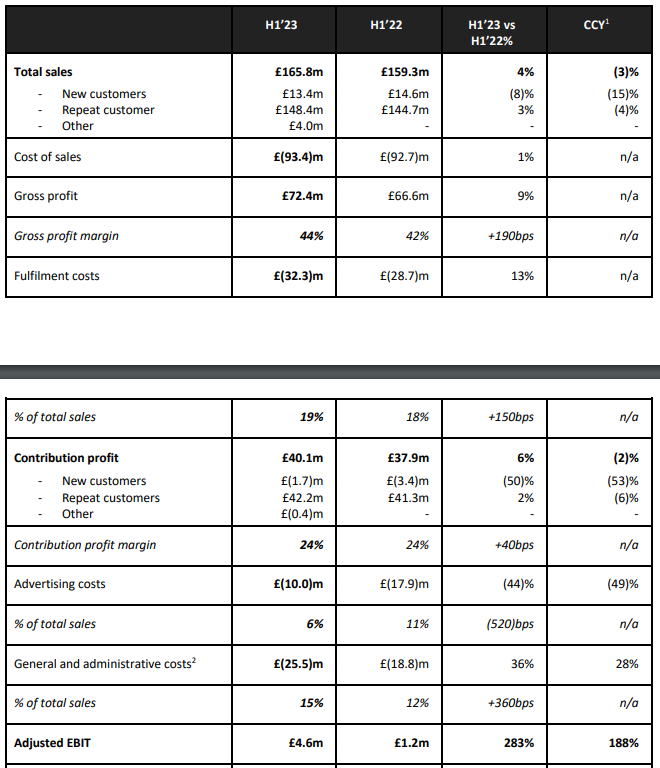

Here is the summary financial exhibit, recapping the 1H:

As you can see, reported sales growth was +4% but -3% on a constant currency basis. That reflects 3% repeat customer sales growth (-4% constant currency) and an 8% decline in new customer sales (-15% constant currency). Essentially, the repeat business held up reasonably well with 76% repeat customer sales retention, but suffered a bit from the lower quality of the FY22 cohort.

However, new customer sales has suffered. As you can see, that’s primarily the result of a 44% decline in advertising costs (-49% constant currency). That is part of management’s “pivot to profit,” which is reducing investment spending and sales growth in favor of profitability. Adjusted EBIT improved to £4.6 million and management expects cash generation in FY24 (ending March ‘24) and beyond.

CEO Nick Devlin wrote that the £4.6 million was “predominantly delivered in our second quarter,” meaning the business is at a higher profitability run-rate than £4.6 million over six months might suggest. It was likely something like £3 million in 2Q, which might suggest something in the low double-digits for a full year run-rate. That’s consistent with FY23 (ending March ‘23) guidance that calls for £9-£13 million of adjusted EBIT, which management expects to improve further in FY24 (ending March ‘24).

Looking down the P&L, you can see the key drivers of the 1H profitability improvement. £5.8 million improvement in gross profit partially offset by £3.6 million higher fulfillment costs led to £2.2 million higher contribution profit. And then £7.9 million lower advertising costs were partially offset by £6.7 million higher G&A to get to £3.4 million higher adjusted EBIT.

Big Picture

Naked Wines was growing sales at a mid-teen pace in the two years before the pandemic. It then accelerated sales growth to 68% in its fiscal 2021 year (ending March 2021). Management ramped up inventory orders and new customer investment with the expectation that healthy customer acquisition and robust sales growth would continue. Naked’s stock went from around £2 per share in March of 2020 to over £9 per share in the spring and summer of 2021. The market cap went from around £150 million to around £650 million.

Like so much else, the growth turned out to be transitory. We now know Naked overspent during the pandemic on what turned out to be lower quality customer cohorts who had lower retention and lifetime value. It seems more of those new customers just wanted to buy wine online while they had to and have since reverted to old behaviors. Naked is still a much larger business though—Active Angels are up 57% since pre-pandemic, a sharply higher trajectory than the business was on previously. But Repeat Customer Sales (Angel Sales) per Angel have normalized to pre-pandemic levels. At the same time, inventory has tripled since pre-pandemic, far more than needed, tying up large amounts of cash.

This turn of events made it unclear for a moment this summer whether Naked had sufficient liquidity. In its FY22 ending report in June, it raised the issue of whether the business should be considered a “going concern,” and discussed certain scenarios that would put its financial position at risk. The stock tanked to as low as £0.75, a £55 million market cap and slightly below my estimate of its liquidation value.

Management has since brought back James Crawford who had been leading the U.K. business as permanent CFO. They successfully renegotiated the credit facility to be more appropriate for the new circumstances. As of September, the business had £23 million of net cash and another £41 million of availability on the inventory facility for a total of £64 million of committed liquidity. While Naked is going to consume a bit more cash in 2H FY23 (ending March 2023) due to inventory commitments, management expects to be cash flow positive in FY24 (ending March 2024) in part because inventory should decline by £65 million. So their liquidity resources now seem more than sufficient.

Management reduced headcount by 32 in the first half. They have passed along inflationary pressure to customers more aggressively than it had previously—running the successfully executed Australia playbook in the U.S.—and have increased free shipping minimum order values to $200 in the U.S., helping to improve margins. You can see some of this in this exhibit from their 1H presentation—passing along inflationary pressure through higher AOVs is more than offsetting higher COGS and fulfillment costs per order and generating higher repeat contribution profit per order.

In addition, they are also paying excess warehousing costs and seeing underutilization of assets due to the excess inventory and lower than expected demand. That’s more than ~70 bps of margin pressure that is expected to unwind over 12-18 months.

They have also reduced losses on introductory first cases, which both saves money and attracts higher quality customers—a neat trick that someone probably should have figured out sooner. More on that later. They have expanded the range into higher end wines, which have higher gross profit per order but the same fulfillment costs per order. They are dramatically reducing new customer investment for now, which is hampering sales growth but resulting in stronger financial returns on a smaller number of higher quality customers. Guidance for fiscal 2023 calls for essentially no sales growth as modest new customer growth replaces those lost to churn.

Is The Strategy Working?

It does look that way. Naked doesn’t report quarterly results but did disclose a couple