Naked Wines: Driving Out the Costs No One Can Taste

Quality wine for less money? Is the premise even true?

This is the first of what will be a few posts about Naked Wines.

It was 2014 or 2015 when I first heard about Naked Wines. My wife and I received one of their vouchers offering $100 off a case of wine in an e-commerce box. I was skeptical but I briefly looked into it. I remember the pitch was that you become an “Angel” and automatically contribute $40 per month towards your wine purchases. I cynically assumed this was just a creatively-marketed business idea meant to get an interest-free loan from subscribers to fund their business upfront. “Clever, but why would I give them an interest-free loan? What’s in it for me?” I thought. I threw the voucher away without investigating further.

Fast forward to 2021—pandemic times. I’d seen some interest in Naked Wines as an investment and decided to give it a try as a customer first. Twist my arm. I signed up and ordered the Naked Wines Red Wine Discovery 6 Pack that had a given market price of $139.99. My $100 off voucher made it $39.99 all-in with free delivery and no tax. That was $6.67 per bottle—a price so low the wine didn’t need to knock my socks off; it only needed to be drinkable. My expectations were low.

As it turned out, none of the bottles knocked my socks off. But frankly, that would have been too much to expect at that price. But every bottle was drinkable or better. I become an Angel and have been ordering since, strictly of course, for due diligence purposes.

My verdict on the wine: most of the wine is good, and some is actually great, but you have to order enough to figure that out. We have had one bottle that was bad that we couldn’t drink, which Naked will immediately credit you for. I think that was an anomaly because we had had that particular wine before and it was fine/good. If you rate the wines the site will recommend wines to you. Also, most of the wine is on the young side. That means it can be good right now, especially if you open it a couple hours in advance and use an aerator or decant it, but it should continue to improve with some aging.

If you want a $100 off voucher and a 1.5L magnum bottle (claims to be worth over $94), feel free to use my referral link (https://us.nakedwines.com/invite/implied-expectations). I’ll get $40 of free wine too. If there is any chance of you making an investment, trying the wine first is obviously a prerequisite. They’ll also give you a full refund if you aren’t a fan so there’s no risk. We can swap notes.

Introduction

Naked Wines is the largest direct-to-consumer winery in the U.S. and operates in the U.K. and Australia as well. For the most part, I’ll be talking about the U.S. business and opportunity because that is by far the largest opportunity going forward.

Naked has a very unique model. On the consumer-facing side, it’s a subscription model where customers agree to contribute a fixed amount each month—the default is $40 in the U.S.—into their Naked Wines account. But this is not a subscription fee. Subscribers, called Angels, can use the balance in their accounts towards the purchase of wine. It is like a wine savings account or wine piggy bank. Unlike wine clubs, no wine is automatically shipped to you, so you don’t need to worry about getting wine you don’t want. You can pick and choose which wines to order, when to order, and pay using the balance in your Angel account and additional funds by credit card, if necessary.

Of course, there are benefits to being an Angel, which I did not take the time to understand seven years ago. The Angel funding gives the company the working capital necessary to partner with and fund the wine production by independent winemakers. So you can feel good about that. And in return for that upfront funding, Angels are offered the wines at significantly discounted prices. Typical discounts are 30%-50% from market value. You could call them wholesale prices.

On the winemaker side, Naked is a platform that enables winemakers to focus on making great wine, without financial risk, for a large pre-existing customer base who is primed to buy it. While arrangements with winemakers differ depending on their needs, typically Naked pays for the cost of grapes and production upfront, the winemaker makes the wine, and when it’s ready Naked makes it available for sale to its 964,000 and counting group of Angels. For the winemaker, the beauty is four-fold.

They get to have their name on the label and establish their brand.

They get to focus solely on winemaking instead of sales, marketing, distribution, finance, compliance, regulation, and operating a winery P&L.

They avoid financial risk because Naked funds the production upfront and commits to buying the wine because it knows it can sell it to its 964,000+ Angels who have mentally pre-committed to buying it with their Angel funds.

They get a more resilient stream of income because Naked represents a different sales channel than other traditional winery business they may participate in that is often more vulnerable to recessions, seasonality, or even pandemics.

That is attractive to winemakers who are able to focus entirely on their craft rather than the less fun, more difficult selling, marketing, distribution, and administrative aspects of running an independent winery. They can also have more freedom to make wines using better grapes, production techniques, or experiment more with niche varietals since Naked has greenlit it, is funding it, and there’s no financial risk. And since the winemaker gets funded up front and doesn’t have to spend time and money on sales, marketing, and distribution, there is room in the value chain for Naked to offer the wines to Angels at significant discounts to market value while still allowing winemakers to make a good living and Naked to have very healthy contribution margins.

It’s hard to overstate how difficult it is making a living as an independent winemaker. For many, it’s actually considered a passion-project that doesn’t actually make a profit. Generally, winemakers spend three months of the year making wine and nine months trying to sell it. That means traveling, meeting with distributors, doing tastings, and trying to generate interest in the wine. But getting distribution is difficult because the big distributors are not financially incentivized to partner with small independent wineries when it is easier just to partner with the largest winemakers—Treasury, Gallo, and Constellation—and their hundreds of wine labels. After all, retail consumers aren’t even aware that 70% of the wines in your liquor store are made by the five largest winemakers. So there would be a lot of cost and not much benefit for distributors to spend their resources seeking out and distributing wine from small, limited production independent winemakers.

Consider this quote from Naked’s CEO Nick Devlin. It’s from his appearance on winemaker Jim Doane’s The Inside Winemaking Podcast. Jim is a winemaker for Naked.

I think what’s changed over time is that the group of people who are interested [in becoming a winemaker for Naked] has broadened a lot. And there’s a lot more people who are successful, who’ve got a lot of things going on, lots of different choices, but are saying, “Actually, I’d love to be involved with Naked. I can see where this is going. There’s already a community of 400,000 members here in the U.S. today. I think we’ve got an opportunity to build a community of millions over the years to come and I want a piece of that. I want to grow a brand in partnership with Naked where they can access that.” That’s been one change. The scale we’ve attained means I think people have recognized that commercially it’s a very exciting opportunity. That absolutely helps us as well. So all of that adds up to we’ve changed from having to really be scrappy hunters… We used to have to work really hard to go and bring winemakers on. We’d have very long lists. We did a lot of courting. What’s really changed is now we have an enormous amount of inbound inquiries. You’ll probably get these soon—people will start asking you when you do a project with Naked, “How did you make that happen?” and “Who should I talk to?” and “How does that work?”

I had a conversation with Rudy von Strasser who we’re doing some great stuff with out on Diamond Mountain. And we’d been working with him for about a year. And we’re having this conversation and he said, “I think I really get it. What you’re telling me is I can just make beautiful wines on Diamond Mountain here and you’ll take care of all the stuff I don’t want to do? And I can just make the wines how I want to? And you’re taking the commercial risk on buying them?” I said, “Yeah Rudy. That’s how it works.” And he said, “God damn. If I’d got that sooner, I’d have been all on board years ago.”

Naked Wines CEO Nick Devlin on The Inside Winemaking podcast

The Premise

Naked Wines claims to sell any given quality of wine for less money. That is a bold claim that deserves scrutiny. It’s also crucial to the investment case. Let’s start with this slide from one of their investor presentations.

If you think about the bottle of Napa Cab at your local wine shop, you as a customer are the third buyer of that wine. That is due to the three-tier distribution system in the U.S. The winery has already sold it to a distributor and the distributor has already sold it to the retailer. That is three mouths to feed. If you’re paying $60, the retailer probably bought it for something around $35 from the distributor who probably bought it for something around $24 from the producer who probably made it for $12, which might be something like $10 of juice and $2 for the bottle, cork, and label, including labor.

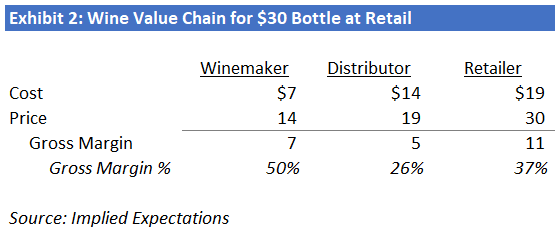

As you can see, retail buyers of wine in the U.S. are paying about 6x the cost of the juice in the bottle and about 5x the winemaker’s cost. Of course, not everyone is buying $60 bottles of wine at retail. But the dynamic is similar at lower prices points as well. Exhibit 2 shows my estimate of how a $30 bottle at retail moves through the value chain.

As you can see, the consumer is paying $30 for about $5 of juice and $7 with the packaging. Regardless of retail price point, U.S. wine buyers pay enormous markups for wine because of the three-tier system. That means U.S. wine buyers pay more for the same quality of wine than anywhere else in the world. I did not fully appreciate that until now and I don’t think most people realize that either.

One might think buying wine direct from the wineries tasting rooms or their wine clubs would avoid these markups. But wineries almost always sell their wines near their retail price points. That is the case for two reasons. First, if wineries were to undercut their own retail prices it would hurt their sales at retail, upset their distributor/retail relationships, and could put that distribution at risk. Second, U.S. wine buyers have been trained to expect these high retail prices so there is no reason for wineries to discount their wine when selling DTC. So Naked’s positioning as the only DTC winery selling at wholesale prices remains intact.

Is The Wine Really Priced at a Discount? Is the Premise Even True?

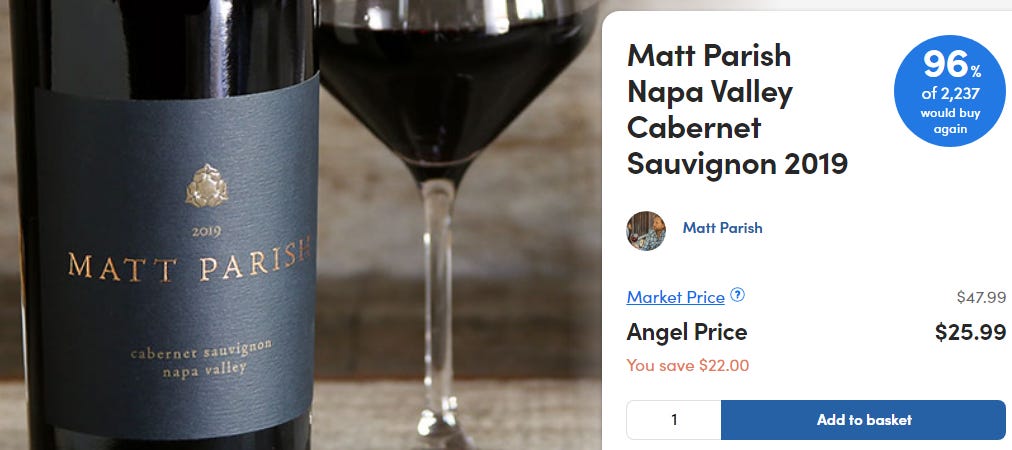

It can be hard to prove that one bottle of wine is just as high quality as another because everyone’s tastes are different. I had initially been skeptical that Naked’s wines truly have the market value that they say they do. Here’s an example from one of my favorites from Naked so far.

Is the market price really $48? What makes it so? This wine is exclusive to Naked so there’s no evidence that this wine sells for $48 at retail. We have to take their word for it that the quality of the grapes and winemaking techniques and resulting flavor profile makes this wine something that would be priced at or around $48 at retail.

That said, Matt Parish is a well-known A-list winemaker with over two decades of winemaking experience, including at at Stag’s Leap and Beringer. Among other things, he is currently the head winemaker at an “ultra-premium,” small production, boutique winery in the Anderson Valley called Lula Cellars. Their 2018 Cab goes for $55.

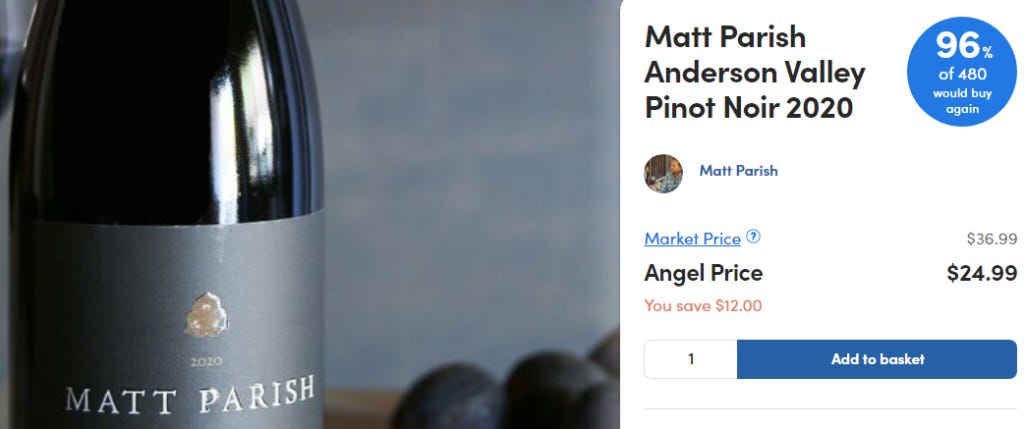

And here is a 2020 Anderson Valley Pinot made by Matt for Naked with market price of $37…

…compared to a 2019 Anderson Valley Pinot made by Matt for Lula Cellars that sells for $45.

It is clear that Matt Parish is a highly respected winemaker who makes high-end wine. This is not some random crowdfunded hobby winemaker whose run-of-the-mill wine gets slapped with an inflated market price on the website. The wines Matt is making for Naked have his name on the bottle. It’s his own brand. It would be hard to believe he would cut corners with grape quality or winemaking techniques with the wines he makes for Naked, especially since his reputation is right there on the label. Plus, he would have no reason to do so. Naked is willing to fund whatever grapes and winemaking techniques he wants to use because, as I’ll discuss later, using premium fruit doesn’t actually add very much to the cost to make a bottle.

Another example is from a winery that I’ve known and enjoyed outside of Naked. It’s called Elyse. They actually ended up participating in Naked’s $5 million COVID Relief Fund in 2020. That was an initiative to partner with and support struggling winemakers since so many had their revenues plummet during the pandemic. Here is the Elyse wine that sold through Naked during their partnership. Notice the $45 market price and the nice Angel discount.

And here’s Elyse’s current lineup of Zins from their website, each with a $45 price tag.

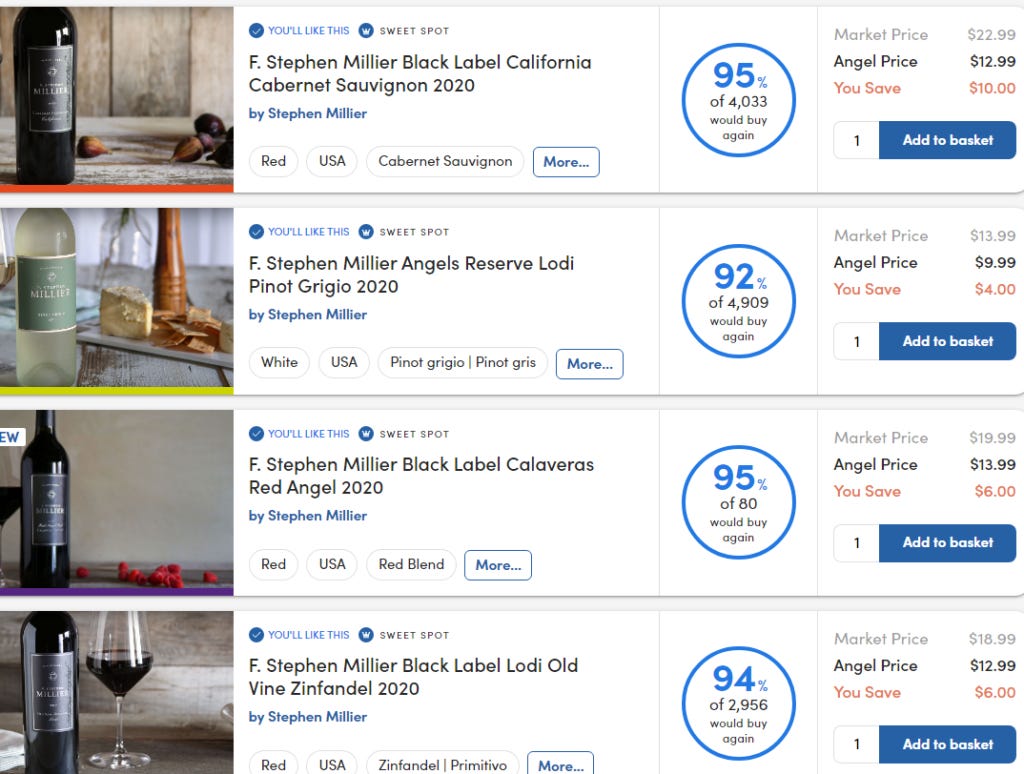

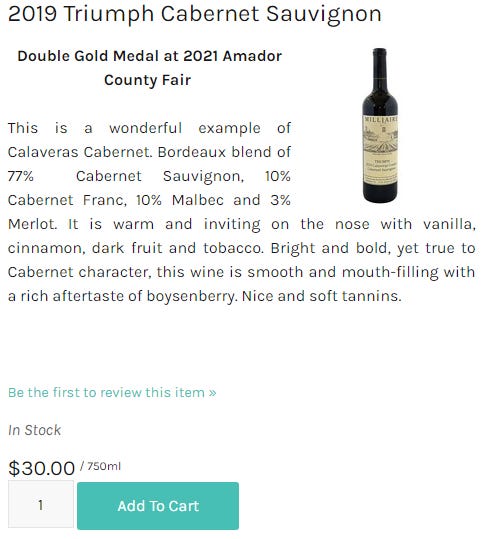

Finally, let’s talk about Naked’s best-selling winemaker Stephen Millier. On Naked’s site and app, his wines have listed market prices that range from $12 to $30 per bottle and the discounted Angel prices that range from $9 to $17. These are mass market price points. Here’s a sample.

Stephen also owns and operates Millier Winery in Murphy, CA where he sells his current release wines for an average price of $25 per bottle ($12-$34 is the range).

That Black Label Calaveras Red Angel 2020 blend shown above, which looks like mostly cab, has a market price of $20. It sounds fairly similar to his 2019 Triumph Cab blend on his website, which sells for $30.

I think it’s clear that Naked’s winemakers are legit winemakers who sell their own wine outside of Naked for prices at or above Naked’s “market price” indications and substantially above the discounted Angel prices. Angels do indeed appear to be buying better wine for less.

We can also look to this chart from Naked’s slide deck. It shows that at every given Vivino wine rating, Angels pay less for wine from Naked than people pay for wines with those ratings generally. For example, for wines rated 4.0 on Vivino the average price is about $32 but Naked Angels pay about $18. And that gap gets wider as we move up the quality spectrum, which makes sense because it’s not possible to make wine taste any better above a certain level and Angels aren’t asked to pay for overpriced wine.

Finally, Angels rate the Naked wines, including on whether they’d buy it again. Any wines that score lower than 85% saying yes are essentially on the chopping block. Most of the wine seem to score above that level in the 88%-95% range. That means a large crowdsourced sample of wine drinkers indicates these are good wines that are worth buying again at these prices. And if you think about it, that’s really all this comes down to—do enough Angels like the value proposition enough to continue as repeat buyers? Given typical repeat customer sales retention in the low-to-mid-80%s, which seems higher than other wine clubs, I think the answer is yes.

The Cost to Make Great Wine

To elaborate on the point made by the high end of the Vivino chart, the actual cost to make great wine is not that much higher than the cost to make good wine. Consider this from Naked’s founder Rowan Gormley from his appearance on a podcast.

The thing that I never knew is the difference between the price of the fruit that goes into Oyster Bay at £6 per bottle or Cloudy Bay at £26 per bottle is—about how much would you say? So £20 difference in retail price. About 30p. That is the difference between premium fruit and average or commodity fruit. So when Bill (a winemaker) said to me, “Look, we could spend £1,200 a ton or £1,500 a ton,” I was thinking, “Oh, we should go with the £1,200 a ton because we need to keep costs down.” And then you work out, divide that by 1,000 bottles, that’s New Zealand dollars, that’s 30p. “Buy the best Bill! Go crazy! Go mad!” And once you understand that, it’s a bit like perfume possibly that actually spending the money to put the best ingredients inside the bottle costs relatively little money, but it makes a better product, which means the customers stick with you, which means you get the loyalty, which means you don’t have to waste five times that amount of money on marketing to go and recruit those customers again. And that’s kind of the insight that—we were just like, “That’s how we should do this.” It’s not about making the wine cheaper. It’s for the same price you’d pay for a supermarket wine, make it an absolute fuck off bottle of wine. Sorry, am I allowed to say that? Make it an amazing bottle of wine.

Naked Wines Founder Rowan Gormley

That means Naked can buy the higher quality grapes, use the right barrels, and use premium winemaking techniques without increasing its per-bottle cost very much. And then by leveraging its scale to procure bottles, corks, labels, and other supplies more cheaply than independent winemakers can, by eliminating the distributor middle man in the value chain, and by eliminating winemaker sales, marketing, and distribution costs, there is so much more room for Naked to offer quality wines for substantially lower than retail prices while still paying the winemakers and themselves well.

One might ask, “If better grapes only adds 30p to the cost of a bottle but adds £20 to the retail price of the wine, why doesn’t everyone do that?” I think the answer is supply and demand. If everyone did that the £26 price point would become too competitive and each participant would sell less wine while the £6 price point would become less competitive and each participant would generate unusual profits. Rational economic behavior corrects this. But Naked can do this because they have eliminated so many other costs in the system that it can easily afford the modest incremental cost of using premium fruit and winemaking techniques. That’s how Naked sells quality wine at wholesale prices.

Growth

Naked Wines has grown its Active Angel base consistently over time. As you can see below, Angel growth was significantly boosted by the pandemic.

Naked grew U.S. revenue at a 23.9% annualized rate in the four years pre-COVID and then surged 78% in FY2021.

U.K. sales grew at an 11.1% annualized rate pre-COVID before growing 66% in FY2021.

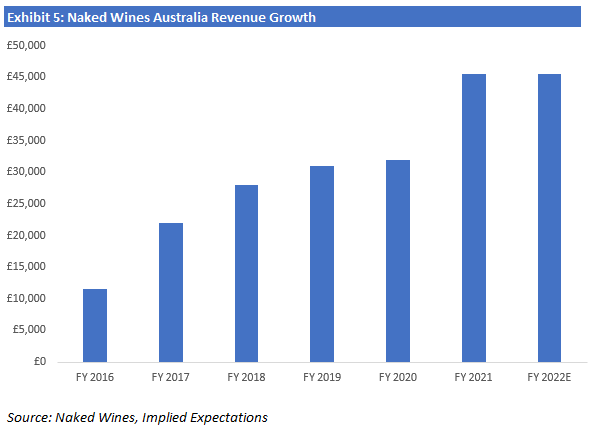

Australia sales grew at a 29.2% rate pre-COVID before growing 42% in FY2021.

The most interesting growth opportunity for Naked is the U.S. for two reasons. Naked’s U.S. addressable market is almost 8x the size of its U.K. TAM and 14x the size of its Australian TAM. In addition, the existence of the three-tier system in the U.S. makes Naked’s value proposition much greater than it is elsewhere.

When I think about the long-term “inevitability” of a business, the first thing I think about is whether the customers will still be buying as much or more of the general product or service in 10-20 years and beyond. Wine consumption is almost as old as time, industry volume consumption is stable, and the direct-to-consumer portion of the industry is growing nicely and gaining share (see below). It is probably fair to say more wine will be sold online in the future than it is today. As the largest DTC winery in the U.S., Naked should probably benefit.

The second thing I think about I think about is whether the company offers the best value proposition to the customer. My sense is that’s true as well. And the third thing I think about is whether the unit economics are attractive. As you’ll see in my next Naked post, I think that’s clearly true as well. So as long as consumers are still buying wine and they appreciate good wine at wholesale prices, then it feels rational that Naked should also continue to gain share over the long term. Given their 1% market share of their $20 billion addressable market in the U.S. and their trend of market share gains, it’s not hard to imagine Naked being a bigger company in the future. And given the long-term tailwind of DTC wine gaining share, Naked would have the wind at its back even without the unique value prop or Angel/winemaker angle.

Do I think Naked is necessarily going to “disrupt” the wine industry? No, probably not. That is a buzz word without much meaning, and 0/1 labels like that are probably not useful. There is simply an enormous lane between a) disrupting the wine industry and b) growing enough to earn shareholders attractive returns. Decent sales growth plus attractive incremental contribution margins, especially in the U.S., means Naked should be nicely profitable at scale. This is also a business that gets much better with scale, one of several topics I’ll talk about in my next Naked post.

Thoughts or feedback on the wine or the business? impliedexpectations@gmail.com

And here’s the link again to the $100 off voucher and free magnum sized bottle: https://us.nakedwines.com/invite/implied-expectations

[EDIT: My next post about Naked Wines, including a discussion of the unit economics, how I model the business, recent business results, my long-term scenario analysis and valuation, as well as a potential catalyst, can be found here: Naked Wines: The Playbook.]

Disclosure: Long WINE.L