Chipotle's densest states as far as population per unit are Ohio, Colorado, and Maryland.

At those states' density levels, the lower 48 could have 5,000 units long term. And Chipotle is still opening new units in those states at a mid-single digit rate.

5,000 total units in the U.S. is not crazy, but my Bear, Base, and Bull case scenarios conservatively assume 4,000, 4,250, and 4,500 total units at potential.

Chipotle's management believes there is room for at least 5,000 Chipotle locations in the U.S. over the long term. There are currently 2,330 in the U.S., so management believes it can double its store count over time.

This is a fairly critical assumption when valuing Chipotle shares because a significant portion of the value of the company is the present value of the new units it will open in the future. I would not accept management's claim without trying to gauge the extent to which it is realistic.

To gauge where this 5,000 figure is realistic, I looked at the disclosure in the 10-K showing Chipotle locations by state over the last few years.

Then I compared 2016 year-end store counts by state with the states' population figures.

whole lower 48 states. For example, if the lower 48 states had the store density that Arizona has there would be 4,056 Chipotles in the lower 48 states over the long-term.

To calculate the implied unit potential at current state density, I started with the U.S. population of 323,127,513, as of year-end 2016. I deducted the populations of Alaska and Hawaii, since I'm assuming Chipotle only works in the lower 48 states, to reach a lower 48 population of 314,767,885. (There are no units in Alaska or Hawaii right now, suggesting those states might present a logistical or supply chain problem). If that figure grows at 0.73% annually—the same compound annual growth rate at which it has grown from 2010 to 2016—then the lower 48 population will be 357,955,834 in 15 years.

So for the implied unit potential at current state density column, I divide the 357 million figure by the population per unit.

I ignore D.C. because it's small and unique, and focus on the densest markets of Ohio, Colorado and Maryland. The store density in those markets certainly suggests a lower 48 potential of around 5,000 units, assuming the rest of the U.S. could get as dense as those states over the long term.

I also focused on to what extent the store bases in those states are still growing from these density levels. The first exhibit shows Ohio, Colorado, and Maryland grew their store bases by 6%, 0%, and 17% in 2016. In total, those three states grew their total units by 4.3%, 4.8%, and 6.9% in 2014, 2015, and 2016, respectively.

So my conclusion is that even at densities that imply 5,000 total units are possible, Chipotle is continuing to open additional stores in those states. So it is possible that one day these states might have store densities that suggest 6,000 units are possible long-term.

While this analysis shows 5,000 units nationwide is not crazy, it also takes a bit of faith to suggest Chipotle can achieve the nationwide store density that it currently has in its densest states. That is why I'm not assuming 5,000 total units in any of my scenarios. My Bear, Base, and Bull case scenarios assume 4,000, 4,250, and 4,500 total units at potential.

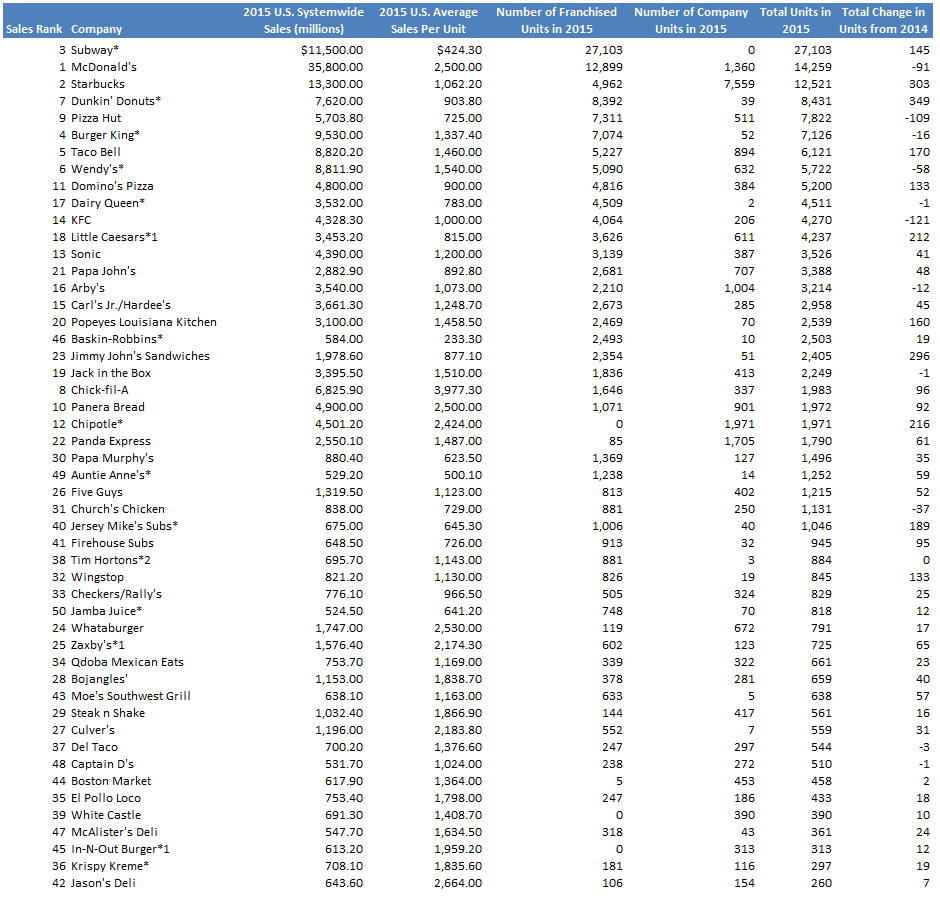

For perspective, here is a table showing several metrics for the top 50 U.S. quick-service restaurant chains, sorted by total units. Notably, several chains have more than 5,000 total units in the U.S. and some of them are still growing units.

In addition, Canada has additional potential. There were around 23 Canadian units as of September 30, 2017, and management has called Canada a proven growth market. Canada's population is about 11% of the U.S. population, so if one assumes the U.S. can have 4,250 units then Canada could have 468 stores at the same density. However, it is possible Chipotle doesn't work as effectively in Canada, so I think 200 stores is a more conservative assumption. Those stores would be incremental to my scenarios and would increase my appraisal of CMG shares by a small amount.

Disclosure: Long CMG