CMG is trading at a premium to my Bear case, a modest discount to my Base case, and a large discount to my Bull case.

I rely on my Base case scenarios, but you should consider my assumptions and whether or not they make sense to you.

At $320 per share, I expect CMG to compound at a low double-digit rate over time if my Base case scenario plays out.

However, this analysis does not account for a large corporate tax cut, which has the potential to lower Chipotle's tax rate from 38% to as low as 20% or 25%.

This report has four components:

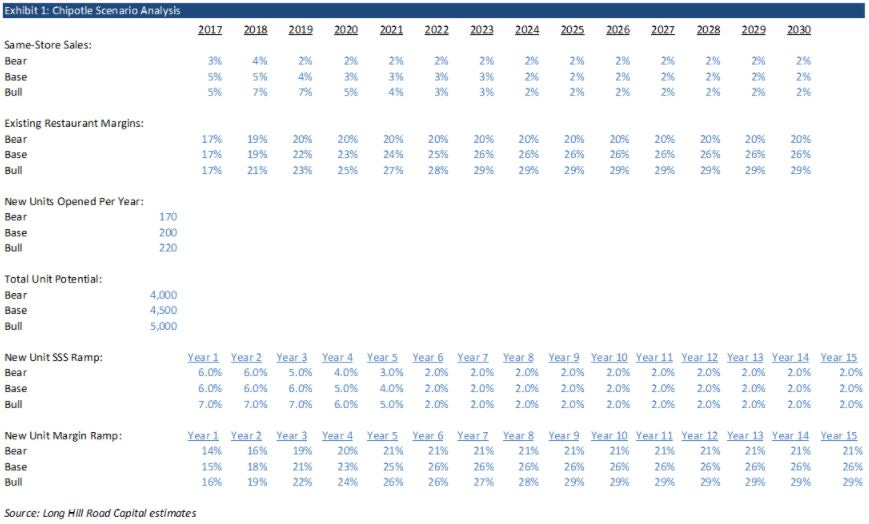

Base case, Bull case, and Bear case scenarios for Chipotle’s long-term future

Detailed discounted cash flow (“DCF”) models for the existing store base for each scenario

Net present value ("NPV") analyses for future new units for each scenario and corresponding DCFs that value each of those new unit cash flow streams

A valuation table showing the intrinsic value of CMG by scenario

Chipotle Scenario Analysis

The Base Case scenario is the scenario that is the most likely to occur, in my judgement. I consider it neither optimistic nor pessimistic. That said, no one can predict the future, and Chipotle’s future is guaranteed to differ from the Base case to some extent.

The Bull Case scenario is a future that is better than the Base case. I consider it optimistic, but not unrealistic.

The Bear Case scenario is a future that is worse than the Base case. I consider it pessimistic, but not unrealistic.

Base Case

For each scenario, I value Chipotle’s business in two parts:

The existing store base

The present value of future store unit growth

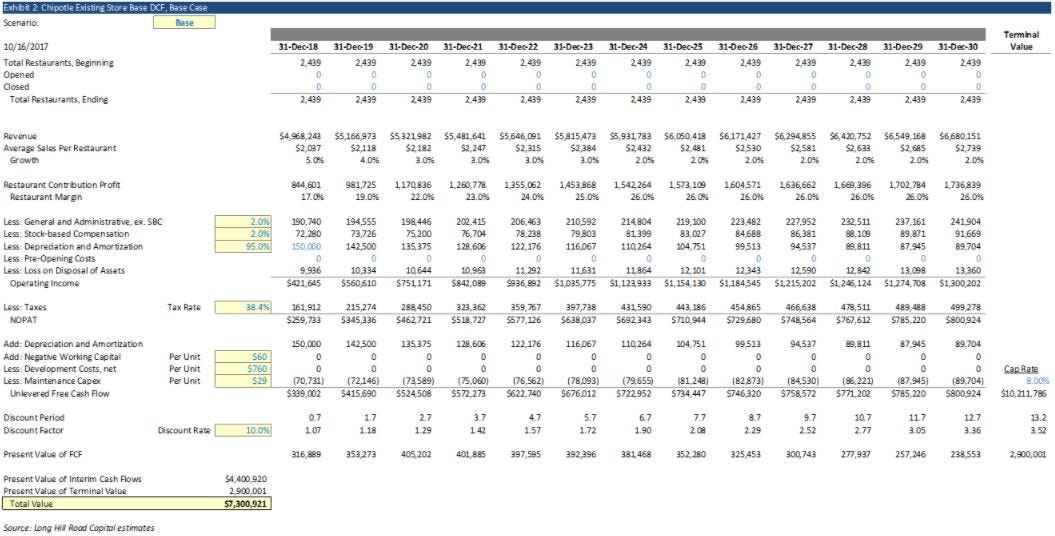

Exhibit 2 shows my DCF for the existing store base in my Base case.

For the present value of future store growth, there are two steps. Step 1 estimates the present value of one new unit. I do this in Exhibit 3.

Chipotle appears to be creating about $2.3 million of NPV each time it opens a new unit, so I spread that value creation engine over time in Exhibit 4. Bear in mind, the unit growth pace and total units at potential are linked to the scenario table.

Bull Case